x402: The Missing Payment Layer of the Web

Executive Summary

This article includes three summaries written for different types of readers:

🟦 For the Curious: New to crypto or just exploring? Start here.

🟨 For the Enthusiast: Know your staking from your slashing? This is for you.

🟥 For the Builder / Founder: Deep dive into system design, trade-offs, and strategic context.\

Choose the one that best matches your background or read them all for a layered understanding.

🟦 For the Curious

The web can move information instantly, but it still struggles to move money. Every payment online depends on accounts, platforms, and processors that sit outside the web’s native protocols. x402 changes that. It brings payments into HTTP itself, the same standard that moves nearly everything on the internet.

When a website or API wants to charge for access, it can now reply with a simple code, 402 Payment Required. The client pays, retries the same request, and the server delivers the result. This small loop turns payments into a native part of how the web communicates.

x402 works with cryptocurrencies and stablecoins, but it is not another blockchain. It is a shared rulebook that lets any wallet or web service talk about value the same way they talk about data. The goal is simple: to make sending money across the internet as easy as sending information.

🟨 For the Enthusiast

x402 is an open standard that gives real meaning to the HTTP 402 status code, reserved since the 1990s for “Payment Required.” It defines how clients and servers negotiate payments using structured messages, cryptographic signatures, and a familiar request–response cycle.

When a client requests a paid resource, the server returns a 402 response containing a Payment Required Response. The client signs a Payment Payload, retries the request with this payload in a header, and the server verifies it. A facilitator may handle on-chain settlement, but the handshake itself happens entirely over HTTP.

This design borrows ideas from existing payment systems but removes their friction. There are no API keys, user accounts, or external processors. Payments become stateless, atomic, and self-verifying. The same pattern that powers caching and authentication now powers value exchange.

Because x402 builds on existing web infrastructure, it is already compatible with browsers, APIs, and server frameworks. It can work with stablecoins on Ethereum, Layer 2 networks like Base, or any asset that supports cryptographic authorization. The result is a universal payment handshake for both human and machine clients.

🟥 For the Builder / Founder

x402 reintroduces something the web was meant to have: a built-in way to pay for access. Its architecture follows a simple principle of minimalism and composability. Instead of defining a new protocol, it extends HTTP with one status code and two standard headers. This keeps adoption costs low and makes it compatible with the infrastructure developers already use.

The payment flow is stateless. Each Payment Payload contains all required fields, including a nonce, expiration time, and signature, allowing verification without stored sessions. The facilitator role provides optional scalability, abstracting blockchain execution without taking custody of funds. For settlement, x402 implementations often rely on EIP-712 for message signing and EIP-3009 for delegated token transfers, enabling gasless, verifiable payments.

Compared with Interledger or Lightning, x402 trades multi-hop complexity for single-hop ubiquity. It is not designed for streaming payments but for instant, direct exchanges between client and server. That makes it ideal for pay-per-use APIs, metered compute, and AI-driven agents that need to purchase data or context autonomously.

The standard’s ecosystem is expanding quickly. Coinbase provides the reference implementation and a managed facilitator, Cloudflare integrates it into web infrastructure, and Google’s Agent Payments Protocol (AP2) uses x402 as the payment layer for AI agents. Together, these efforts position x402 as the most practical path toward a web that can handle not only requests for data but also payments for it.

x402 gives developers, businesses, and autonomous systems a shared, open grammar for value exchange. It is the missing payment layer of the web.

The Missing Payment Layer of the Web

The internet moves information effortlessly, but money still travels like it did decades ago. Every website, API, or digital service that charges for access depends on layers of intermediaries: processors, subscriptions, accounts, and human checkpoints. You can stream video or fetch data instantly, but you cannot send a cent across the web without going through a platform that manages it for you. The web can move text, images, and code in milliseconds. It cannot move value.

Online payments were designed for people, not for software. When you pay, you log in, confirm a transaction, or sign a message. Even automated systems, like billing APIs or subscription engines, simply replicate human patterns in code. They assume every transaction happens between companies or individuals with pre-existing accounts and trust relationships.

This model works, but it is heavy. A reader who wants to pay fifty cents for a single article often must register, link a card, and remember to cancel later. A developer who wants to monetize an API must integrate a payment processor, track usage, and handle chargebacks. And a small online store that wants to accept crypto quickly discovers that “accepting crypto” is not as simple as it sounds. Choices include custodial gateways with regional limits, self-hosted payment servers that need maintenance, or third-party processors that reintroduce the same fees and friction that crypto was meant to avoid. There is also no standardized, protocol-level way to accept crypto payments directly across the web. In practice, every merchant ends up with a different flow, from QR codes to embedded widgets to polling for on-chain transactions.

The gap is structural. The web has protocols for delivering information, such as HTTP, DNS, and TLS, but none for delivering value. Money is still external, handled by applications rather than by the web itself. Every payment involves an identity, an account, and a trust intermediary. As software becomes more autonomous, that assumption starts to break down.

AI agents and automated systems can already read, reason, and act on data. What they cannot do is pay for it. An agent can query an API but not unlock a paid endpoint. It can recommend a product but cannot complete the purchase. Without a native payment channel, its autonomy ends where a price tag begins. This limitation is not just about AI. It affects every layer of the internet economy: media, SaaS, content, and e-commerce. Machines expose the weakness most clearly, but humans experience it every day through subscriptions, platform lock-ins, and friction around small payments. The result is a web where access to information is global, but access to paid services is still gated by infrastructure that predates the web itself.

x402 was created to fix that. It treats payments not as an application feature, but as a first-class web primitive.

Turning HTTP into a Payment Layer

Hidden in the HTTP standard since the 1990s is a line that reads: 402 Payment Required. It was reserved for a future payment mechanism that never came. Browsers, APIs, and gateways all built their own systems instead, leaving the code unused and waiting. x402 gives that code a purpose by operationalizing 402 as a machine-readable payment negotiation and response path.

The protocol does not create a new blockchain or payment API. It extends HTTP, the language the web already speaks, to include value exchange. When a client requests a paid resource, the server can reply with a structured 402 Payment Required response that includes price, accepted asset, destination address, network, and optional description. If the client agrees, it attaches a cryptographic payment authorization to the same request and retries; the server verifies, settles, and returns 200 OK with the resource. The x402 whitepaper outlines this flow and the fields of the 402 payload, including maxAmountRequired, asset or assetAddress, payTo, network, and related identifiers].

In practice, this looks like any other web interaction. Developers add x402 middleware to an endpoint, specifying cost and payment details. If a user or program calls that endpoint without payment, it receives a 402 with clear instructions. Once payment is attached, the endpoint responds normally. No external billing API, no new account, no subscription. It follows the same rhythm as the rest of HTTP: request, response, retry, success. x402 is to payments what HTTP is to data, a shared grammar that makes exchange predictable.

The Architecture in Motion

The protocol revolves around three main actors:

-

Client: the buyer, whether a human with a wallet or a program with a private key, making the HTTP request.

-

Server: the seller or service provider defining which resources require payment and how much.

-

Facilitator: an optional but common service that verifies signed payments and interacts with the blockchain on behalf of the server.

A typical flow looks like this:

-

The client requests a resource, such as

/api/data. -

The server responds with HTTP 402, listing the price (for example, 0.10 USDC) and where to pay.

-

The client signs a payment authorization using its private key, formatted via the EIP-712 standard, and retries the request with that signature attached in a header.

-

The server or facilitator verifies the signature, executes the transfer on-chain or via a rollup, and delivers the resource with HTTP 200 OK.

For authorizations, x402 adopts EIP-712-style signing so the payload is explicit and replay-safe via fields like nonce, paymentId, and expiresAt. Settlement is flexible. It can be on-chain, on a low-cost rollup, through payment channels, or batched into single transactions for many micros. The specification lists these modes to let operators tune latency and fees to their context.

The simplicity of that pattern is what makes x402 powerful. It does not replace blockchains or payment networks; it bridges them to the web through a universal interface. Any wallet or chain that can produce a verifiable signature can participate. Any web service can accept payment without building custom infrastructure.

Why It Matters for Sellers

For merchants and developers, x402 turns payments from a product decision into a configuration choice. A developer no longer needs to maintain wallet addresses, poll blockchains for new transactions, or reconcile orders manually. Each payment request carries its own proof of origin, price, and completion. The verification step happens within the same HTTP exchange that delivers the product.

Compared to taking direct crypto payments, the difference is about standardization and automation. Direct crypto flows can work well, but they are not standardized across the web and often require bespoke address management, off-band verification, or UX hops between a site and a wallet. x402 defines a consistent per-request handshake, so both sides know how to quote, pay, retry, and confirm.

| Typical challenge in direct crypto payments* | How x402 addresses it |

|---|---|

| Fragmented flows across merchants; no shared protocol semantics for quote, pay, retry, confirm | 402 response carries a standard quote schema; client retries with a standard proof; server responds 200 on success |

| Merchants often build custom address mapping or reconciliation logic, even if not always per-customer addresses | Payment identity and replay protection are embedded in the signed payload with paymentId, nonce, expiresAt |

| UX often requires context switching between site and wallet, even when widgets exist | Client or wallet can respond programmatically to 402, then retry the same HTTP call with authorization |

| Micropayments are hard to make economical on many chains | L2s, batching, and channels are explicitly supported as settlement modes |

| Error and retry semantics vary by implementation | HTTP defines them by design (402 → retry → 200 on success) |

*Not universal. Some gateways abstract these issues, but implementations differ widely because there is no open, HTTP-level standard.

The difference is not just convenience. It is scope. x402 standardizes what used to be bespoke, giving sellers a consistent, programmable way to monetize access at internet scale. They can price content, APIs, or compute by the request, by the second, or by the byte, without subscriptions, intermediaries, or reinventing payment logic each time. For the first time, the web gains a simple and open way to express value exchange inside the protocol itself.

x402 does not invent a new payment network. It extends the web’s existing protocol in a way that makes value exchange a native capability. By reusing HTTP’s request–response cycle, it brings money and information onto the same transport layer. The next section examines how this minimal design was achieved and what trade-offs it introduces.

Design Decisions and Trade-offs

Protocol Philosophy: Minimalism and Composability

x402 takes a deliberately minimal path. Instead of creating a new network or transport, it extends the protocol the web already uses. A payment standard only matters if it can be deployed everywhere, and HTTP is the most widely deployed protocol on the planet.

Rather than define new nodes, message buses, or browser capabilities, x402 revives a long-reserved HTTP status code, 402 Payment Required, and gives it precise meaning. Every interaction follows a familiar pattern. The client makes an HTTP request, the server answers with a 402 that includes a compact JSON quote, and the client retries the same request with a signed authorization. The rest remains pure HTTP.

This is protocol minimalism in practice. x402 adds as little as possible, a status code meaning, a quote schema, and a retry pattern, to make value exchange a native web primitive. It does not attempt to be a new ledger, identity layer, or router of funds. By staying inside HTTP semantics, it inherits decades of tooling and hardening, including reverse proxies, gateways, TLS, caching, and CDN compatibility. If an application can handle 401 Unauthorized, it can conceptually handle 402 Payment Required.

The result is strong composability. Because it rides on HTTP, x402 can sit behind Nginx, inside Express or FastAPI middleware, next to REST or GraphQL routes, and under the same observability and security controls teams already use. No new daemons to run. No special peers to connect to. This lowers adoption cost and reduces the chance that critical pieces live outside the operational perimeter.

There is a trade-off. Staying inside HTTP limits expressiveness. Continuous payment streams, multi-hop routing, and complex escrow flows live outside the scope of a simple request response loop. Systems that specialize in streaming or channel semantics can optimize for those use cases. x402 optimizes for the common case where a one-shot exchange is sufficient, for example a paid API call, a pay-per-view document, or a per-second compute slice. In short, it favors universality over specialization. It aims to be the missing handshake the web never had, not the replacement for advanced payment networks.

Stateless Payment Handshake and Per-Request Pricing

In x402, each payment is an independent handshake. Every paid request carries the information needed to verify and settle the transaction, including the amount, the asset, the destination, unique identifiers, and a signed authorization. The server does not need to keep a billing session or a stored balance to decide whether to fulfill the request.

The server defines what payment is required in the 402 response, including price, asset, and destination. When the client retries with a signed authorization, that authorization embeds all the data the server needs to verify it. The server does not have to preserve any temporary billing session or pending invoice between those two steps. Verification depends on the payload, not stored server state.

This keeps operations simple. There are no pending invoices to reconcile and no monthly cycles to manage for access that was already delivered. Either the request contains a valid payment and returns 200 OK, or it does not and returns 402 Payment Required. The flow begins and ends with the same HTTP endpoint.

The model also maps cleanly to microtransactions. Small, frequent payments are easy to reason about when each HTTP call is its own unit of account. Teams can meter resources by request, by second, or by byte without building a parallel billing system or a credit balance store. It turns usage-based pricing into configuration rather than a secondary application.

There is a cost. Very high frequency services may feel the overhead of signing and verifying many small authorizations. The specification anticipates this by allowing settlement strategies that amortize cost, including low fee rollups, payment channels, and batching multiple micros into a single on-chain transaction. Even when settlement is grouped, each authorization remains independently verifiable. That preserves the clarity and auditability that make the approach attractive.

Compared to streaming or channel-based systems, which maintain shared state across a flow of packets or HTLCs, x402 keeps no long-lived link between transactions. The benefit is implementation simplicity and security isolation. Each exchange stands on its own, which makes it easier to deploy inside existing APIs and easier to reason about under incident response.

Facilitators and the Trust Boundary

In most payment systems, someone has to handle the transaction layer. x402 approaches this through an optional role called the facilitator. The facilitator bridges the web layer, where HTTP requests happen, and the blockchain layer, where value actually moves.

A facilitator is a lightweight service that verifies the signed payment authorization sent by the client, checks its integrity, and broadcasts the on-chain transaction on behalf of the server. It can also confirm the result of the transaction back to the resource server, allowing the server to complete the HTTP request once payment has settled.

This design solves a practical problem. Running blockchain infrastructure is not trivial. A small content provider or developer may not want to maintain full nodes, monitor mempools, or manage gas policies. The facilitator abstracts that complexity, giving web services an API for verifying signatures and submitting transactions while letting them stay focused on their application logic.

Crucially, the facilitator cannot move funds on its own. It only executes signed intents from the client. The authorization payload specifies exactly what can be transferred, to whom, and for how long it remains valid. Any modification would invalidate the signature. This provides a trust-minimized model: the facilitator performs operational work, but it cannot take custody of funds or create transactions that were not pre-approved.

The whitepaper frames this as a security and usability compromise. Purely decentralized systems can avoid intermediaries entirely, but often at the cost of usability and performance. On the other hand, central processors are efficient but create single points of failure and custody risk. x402 positions facilitators in between. They are not required, but they are practical. A large merchant could self-host one, while small developers might rely on a public facilitator service, such as the one operated by Coinbase’s developer platform.

In architectural terms, facilitators play a similar role to proxies or gateways on the web. They optimize, cache, and translate, but they do not own the underlying connection. Each participant can choose whether to run their own or trust an external one. This flexibility lets x402 scale operationally without compromising its protocol-level neutrality.

The trade-off is consolidation risk. If most traffic routes through a handful of facilitator providers, the network could start to resemble traditional payment infrastructure, with a few powerful intermediaries. However, since facilitators do not hold user funds and their logic is open, switching costs remain low. Anyone can deploy a compatible facilitator as long as it follows the verification and settlement rules defined in the specification.

Facilitators are the practical bridge between blockchain settlement and web infrastructure. They make instant, verifiable payments possible without forcing every web developer to become a blockchain operator, while still preserving the open, permissionless nature of the protocol.

Choosing HTTP over New Protocols

The decision to build x402 on top of HTTP was both practical and strategic. HTTP already defines a universal, lightweight language for information exchange. By reusing it, x402 ensures that payments can move through the same infrastructure that already powers the web.

HTTP’s ubiquity provides instant reach. Every browser, API client, and cloud service already understands how to send and receive HTTP status codes. Adding one more, 402 Payment Required, does not require new software stacks or peer-to-peer networks. It works within the same ports, headers, and security boundaries that organizations already trust. Developers can integrate it directly into existing applications without rewriting deployment pipelines or adjusting firewall rules.

Another reason for choosing HTTP is compatibility with modern signing standards. x402 uses EIP-712 for structured data signing, allowing clients to produce clear, human-readable authorizations that can be verified without exposing private keys. The authorization message defines exactly what the client agrees to pay and can be validated by any service that understands the standard. This makes payments transparent to users and predictable for developers.

Building a new transport protocol would have required solving problems HTTP already answers: routing, authentication, error handling, and encryption. By extending HTTP instead, x402 inherits its mature security model. Payments travel over TLS-secured connections, reuse standard headers, and can benefit from existing tools for caching, monitoring, and logging. The result is a payment protocol that fits naturally into the web’s infrastructure rather than competing with it.

This approach mirrors how the internet has evolved historically. The most successful standards have been incremental. SMTP added mail to TCP. REST brought structure to HTTP. x402 adds value exchange to that same lineage. Each step extends an existing layer rather than replacing it.

There are trade-offs. HTTP is designed for discrete request–response cycles, not continuous streams. This makes x402 unsuitable for real-time streaming or multi-hop payment routing, areas where protocols such as Interledger or Lightning perform better. But for most online interactions, from API calls to one-time purchases, HTTP’s simplicity is an advantage. It allows any web resource to become payable through a single standardized mechanism rather than a new transport layer.

In essence, choosing HTTP gave x402 two crucial properties: instant deployability and interoperability with existing web tooling. It bridges traditional web infrastructure and blockchain-based authorization standards, turning payments into a native part of the internet’s existing communication model.

Comparative Landscape

Every major attempt to standardize payments on the web has faced the same dilemma: balancing openness with usability. Some projects built new protocols, others extended existing ones, and many never achieved adoption because integration was too heavy or too narrow in scope. x402 approaches this challenge from a different angle. Instead of inventing a new network, it defines a payment grammar that any existing system can use.

Interledger (ILP) and Web Monetization

The Interledger Protocol (ILP) and its browser-based derivative Web Monetization were early efforts to create a universal layer for value transfer across networks. ILP introduced the idea of packetized payments that can hop between different ledgers. Web Monetization applied that model to streaming content, allowing browsers to send small, continuous payments to websites.

Both standards were technically elegant but operationally complex. They required dedicated connectors, routing nodes, and sometimes specialized browser APIs. Adoption was limited to a few ecosystems because integration meant running new infrastructure. x402 avoids this by staying entirely within HTTP. It does not need new participants or routing logic. Any service that can return a 402 response can use it. The trade-off is that x402 handles only direct, one-hop interactions, not multi-ledger routing. It chooses reach over range.

Lightning L402 and LSAT

Bitcoin’s Lightning Network introduced the idea of fast, off-chain microtransactions. In 2020, the LSAT (Lightning Service Authentication Token) standard proposed combining Lightning payments with HTTP authentication. A server could return a 402 response with a Lightning invoice, and once the payment was confirmed, the client received a macaroon token for access. LSAT demonstrated that HTTP-based micropayments were possible, but the approach remained tightly coupled to Bitcoin and Lightning.

x402 generalizes this idea. Instead of limiting itself to one network, it defines an open schema for how any blockchain, stablecoin, or tokenized asset can be used. The authorization is not a macaroon but a signed payment intent that can be verified universally. Where LSAT required running Lightning nodes and channels, x402 works with standard wallets and HTTP servers. It extends the same concept to the broader internet economy.

Stripe, PayPal, and API-Based Payments

Web-based payment APIs like Stripe, PayPal, or traditional card processors solved developer convenience at the cost of openness. They offer polished dashboards, fraud controls, and fiat settlement but operate as custodial intermediaries. Each processor defines its own API and fee structure. Integrations are proprietary and often region-specific. While these services make it easy to accept money, they keep merchants within their closed ecosystems.

x402 takes the opposite path. It standardizes the handshake itself, not the platform around it. Instead of calling a private API, the merchant’s own server issues the payment requirement. This reduces reliance on third parties and enables true peer-to-peer settlement between client and merchant, even if facilitators help relay transactions. In practical terms, x402 can be thought of as the protocol layer beneath what Stripe’s API abstracts.

ERC-4337 and Account Abstraction

The ERC-4337 standard brought smart wallets and delegated gas payments to Ethereum and compatible chains. It introduced the idea of bundlers and paymasters that can submit transactions on behalf of users. While ERC-4337 improves wallet usability, it operates on the blockchain layer, not the web layer. It does not define how web applications or APIs should request payment from those wallets.

x402 and ERC-4337 complement each other. ERC-4337 solves the wallet experience and sponsored gas, while x402 defines the communication bridge between a web service and those wallets. Together they enable both sides of the transaction: x402 handles negotiation and verification at the HTTP level, while ERC-4337 handles execution on-chain.

| Protocol / System | Layer | Strengths | Limitations | x402 Differentiator |

|---|---|---|---|---|

| Interledger / Web Monetization | Network / Transport | Cross-ledger routing, streaming payments | Complex setup, new nodes, limited adoption | Runs on existing HTTP infrastructure with no new network participants |

| Lightning LSAT / L402 | Application / Off-chain | Instant microtransactions, low fees | Bitcoin-only, requires channels and nodes | Chain-agnostic, uses signatures instead of invoices |

| Stripe / PayPal APIs | Custodial API | Simple integration, strong tooling | Closed ecosystem, fees, no direct ownership | Open standard, non-custodial, direct client-to-server flow |

| ERC-4337 | Blockchain / Wallet | Smart wallet UX, sponsored gas | Blockchain-level only, no HTTP coordination | Complements x402, together enable full payment pipeline |

| x402 | Web / Application | Universal HTTP-based payment negotiation | Single-hop, discrete transfers, depends on facilitators for scale | N/A |

x402 does not replace these systems. It provides the missing web-facing interface that allows any of them to be integrated cleanly. In doing so, it positions itself as the simplest possible abstraction of value transfer over HTTP. Where older systems built new rails, x402 defines the signaling layer that lets those rails connect to the web itself.

Design Tensions and Open Engineering Questions

Every protocol is a set of trade-offs. x402 optimizes for deployability and composability, not for theoretical perfection. Its design choices make it easy to adopt but also introduce boundaries that engineers and protocol designers must navigate carefully.

Statelessness versus Efficiency

The stateless payment model simplifies validation and integration, but it can create efficiency concerns at scale. Each request must be signed, transmitted, and verified individually. For high-volume applications such as streaming data or market feeds, the overhead of repeated cryptographic checks may be non-trivial. Batching and rollups can mitigate the issue, but those solutions shift complexity to the settlement layer. The open question is how to maintain the elegance of per-request verification while improving throughput for high-frequency use cases.

Open Access versus Spam Resistance

A core strength of x402 is that it requires no pre-registration or trusted relationship between client and server. Any client can send a request and pay for access. The same property could, however, expose new attack surfaces. A malicious actor could spam 402 requests to trigger pricing logic or exhaust facilitator resources. Traditional web infrastructure mitigates this with rate limiting and authentication, but payments add a new variable. Finding lightweight, on-protocol methods for detecting or pricing abnormal behavior remains an area for future experimentation.

Decentralization versus Practicality

Facilitators make x402 usable for developers who do not want to manage blockchain infrastructure, but they also reintroduce a form of operational centralization. If a few major facilitator services dominate the ecosystem, the network could begin to mirror the payment processors it aims to complement. The specification keeps facilitators permissionless, yet economic forces often favor consolidation. Designing incentives or discovery mechanisms that keep the facilitator layer competitive and open will be essential for long-term decentralization.

Minimalism versus Expressiveness

x402’s strength lies in its minimalism, but that minimalism also limits what the protocol can do. It handles discrete payments perfectly but does not yet support complex flows such as conditional payments, escrow, or streaming value. Adding too many extensions could undermine its simplicity, while leaving them out might limit adoption in specialized use cases. The community will need to find the right balance between expansion and restraint, deciding whether new capabilities belong in the base protocol or as optional extensions.

Interoperability versus Uniformity

The open schema allows x402 to support multiple assets, networks, and settlement methods. That flexibility could lead to fragmentation if different implementations diverge in how they express prices or verify signatures. Without careful governance, interoperability may suffer. Standardizing asset metadata, network identifiers, and facilitator behavior will be crucial to ensure that an x402 client built for one environment can interact reliably with another.

Usability versus Custody

By design, x402 assumes users or agents control their own wallets. For human users, that introduces a UX challenge: confirming microtransactions, managing stablecoins, and securing keys. Facilitators and smart-wallet layers such as ERC-4337 can ease the experience, but they add complexity and potentially new trust assumptions. The balance between self-custody and convenience will determine whether x402 remains a developer-centric tool or achieves mainstream usability.

Summary

x402 sits at an unusual point in the internet stack. It is neither a financial network nor a traditional API standard but a hybrid that touches both. Its main tension is between purity and adoption. By reusing HTTP, it gives the web an immediate way to express payments. By relying on external facilitators and settlement layers, it inherits their constraints. The protocol’s long-term success will depend on whether its minimal approach can stay simple while absorbing the complexity of real-world commerce.

How x402 Works

x402 defines a simple but complete sequence for how a web client and a server exchange value over HTTP.

Each payment follows a predictable path: the client requests a resource, the server quotes a price, the client signs and submits a payment payload, and a facilitator verifies and settles it on-chain.

The process involves four actors: Client, Resource Server, Facilitator Server, and Blockchain Network.

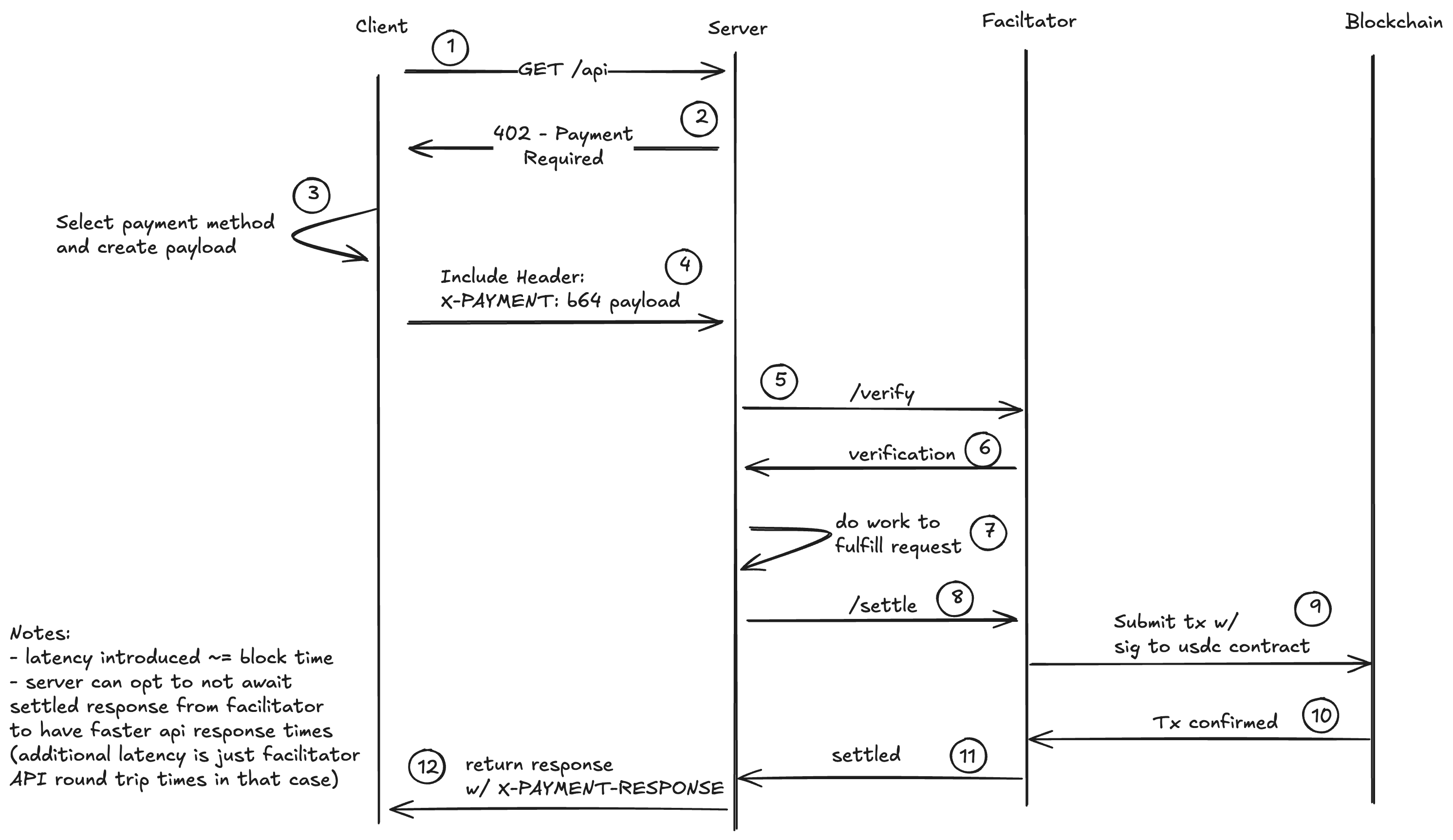

Below is the official twelve-step flow from the x402 github.

The Official Payment Flow

-

Client Request

The client sends an HTTP request to a resource server, for exampleGET /api.

If the client already knows the accepted payment requirements for this endpoint, this step can include payment information directly and skip the next one. -

Payment Required Response

The resource server responds with402 Payment Requiredand includes a Payment Required Response JSON object.

This object lists one or morepaymentRequirements, each describing accepted assets, networks, and prices. -

Payment Selection and Payload Creation

The client chooses one of thepaymentRequirementsand creates a Payment Payload that matches its scheme and network.

The payload includes fields such aspaymentId,asset,to,value,nonce, andexpiresAt. -

Retry with X-PAYMENT Header

The client sends the HTTP request again, this time including the Payment Payload in the headerX-PAYMENT. -

Verification Request

The resource server verifies the Payment Payload locally or by posting both the Payment Payload and Payment Requirements to the/verifyendpoint of a facilitator server. -

Verification Response

The facilitator validates the signature, checks the payment parameters against the Payment Requirements, and returns a Verification Response.

If invalid, the resource server replies with another 402 Payment Required. -

Fulfillment Work

When verification succeeds, the resource server begins processing the request or generating the paid resource. -

Settlement Request

After completing its work, the resource server initiates settlement either directly with the blockchain or by posting the Payment Payload and Payment Requirements to the facilitator’s/settleendpoint. -

Transaction Submission

The facilitator submits the payment to the blockchain using the scheme defined in the payload, for example by invoking a USDC smart-contract transfer with authorization. -

Transaction Confirmation

The facilitator waits for the blockchain to confirm the transaction.

Block time determines latency; servers can choose to wait or to return responses immediately after verification. -

Payment Execution Response

Once confirmed, the facilitator returns a Payment Execution Response to the resource server, including settlement details such as transaction hash and amount transferred. -

Final HTTP Response

The resource server sends200 OKto the client with the requested resource in the body and includes anX-PAYMENT-RESPONSEheader that contains the Settlement Response as Base64-encoded JSON if the payment succeeded.

Official Sequence Diagram

Figure 2: Full x402 payment sequence from the official github. The server may choose not to wait for final on-chain settlement to reduce latency; in that case, response time equals the facilitator verification round-trip.

Figure 2: Full x402 payment sequence from the official github. The server may choose not to wait for final on-chain settlement to reduce latency; in that case, response time equals the facilitator verification round-trip.

Cryptographic Authorization

x402 uses EIP-712 for structured signing.

Each Payment Payload is a typed message that binds all payment parameters to a single digital signature.

This ensures that no field can be changed without invalidating the signature.

For delegated, gasless execution, many implementations rely on EIP-3009 (Transfer With Authorization), which allows a facilitator to broadcast an authorized transfer without the payer sending an on-chain transaction.

Together these standards provide clear, auditable messages for both wallets and agents.

Verification and Security Model

Every Payment Payload contains a unique identifier and expiration timestamp.

Facilitators and servers validate that the payload is signed by the correct address, has not expired, and has not been replayed.

Because validation depends only on the payload and the signature, servers do not need to maintain active billing sessions or shared state.

This keeps verification deterministic and minimizes the chance of replay or double-spend attacks.

Settlement Options

x402 is settlement-agnostic.

Servers and facilitators can choose the method that suits their cost and latency requirements:

-

Direct on-chain execution for transparency and auditability

-

Rollup or Layer-2 settlement for lower fees

-

Payment channels for frequent micro-payments

-

Batched transactions for aggregated settlement

This flexibility allows x402 to operate across multiple networks without changing the web-layer semantics.

Latency and User Experience

Latency equals approximately one block time if the server waits for confirmation.

Servers can choose to return responses immediately after verification to achieve faster API turnaround.

In that case, only facilitator verification adds delay.

This design gives developers a choice between stronger confirmation guarantees and better performance.

Why the Model Works

x402 extends the web’s most familiar pattern.

The same loop that governs authentication and content delivery now governs payments.

It converts value transfer into an HTTP-native process, letting developers monetize endpoints or content with minimal effort.

By keeping both negotiation and verification inside HTTP, x402 brings programmable payments to the core of the internet.

Excellent. Below is Part IV: Ecosystem and Adoption, written in the same professional, analytical style as the earlier sections.

It maps the real-world traction of x402, covering Coinbase’s developer platform, Cloudflare’s collaboration, Google’s integration through AP2, and early developer adoption.

The focus is on credibility and ecosystem growth, not hype.

Ecosystem and Adoption

x402 was released in May 2025 as an open standard by Coinbase’s developer platform. Since then, it has quickly moved from concept to implementation, supported by partnerships with major web and infrastructure players. The early ecosystem is still forming, but its direction already shows how the protocol could scale across both the traditional web and the emerging machine economy.

Coinbase Developer Platform

Coinbase designed x402 as part of its broader effort to standardize crypto payments for developers. The company provides a full reference implementation and SDKs for both servers and clients through its public GitHub repository. The reference code includes middleware for Node.js and Express, a facilitator microservice, and client libraries that handle the entire 402 negotiation automatically.

Coinbase also operates a managed facilitator that developers can use out of the box. This service verifies and settles payments on behalf of applications, abstracting away blockchain management and gas handling. Developers can adopt x402 by adding a few lines of middleware to an endpoint, while the Coinbase facilitator manages verification, signature checks, and on-chain settlement. The hosted facilitator initially supports USDC payments on Base, Coinbase’s Layer 2 network.

By running a public facilitator, Coinbase provides early liquidity and reduces onboarding friction for developers. At the same time, the protocol remains open: any team can run a compatible facilitator if they follow the verification and settlement schema published in the specification.

Cloudflare and the x402 Foundation

In September 2025, Coinbase and Cloudflare jointly launched the x402 Foundation, a non-profit initiative focused on open governance, interoperability testing, and developer education. Cloudflare’s participation is significant because of its reach in web infrastructure. Integrating x402 into Cloudflare Workers and edge computing environments allows developers to add payments at the CDN layer.

Cloudflare also announced plans to experiment with x402 as a mechanism for rate-limiting and API monetization. Instead of blocking excessive traffic, a server could respond with a 402 Payment Required status, allowing automated agents or applications to pay for higher request quotas. This approach aligns with Cloudflare’s role as a gateway for billions of HTTP requests every day, and it demonstrates how x402 can integrate into the web’s backbone rather than living only in blockchain ecosystems.

Google and the Agent Payments Protocol (AP2)

Google’s Agent Payments Protocol (AP2) extends the same vision to AI agents. AP2 defines a set of standards for how autonomous systems request user authorization, manage spending limits, and perform transactions. x402 was included as one of the first official payment extensions supported by AP2.

Under this model, AI agents built on Google’s frameworks can interact directly with APIs or services that use x402. When an agent encounters a paywalled endpoint, it can automatically sign a Payment Payload and proceed without human input. The combination of AP2 and x402 effectively closes the loop for machine-to-machine commerce, allowing agents to pay for API calls, contextual data, or compute resources on demand.

This integration positions x402 as a default payment handshake for the machine web. It provides the HTTP-native layer, while AP2 handles user authorization and spending controls.

Early Developer Adoption

Beyond the large partnerships, x402 has already gained traction among independent developers. Several open-source projects have implemented community facilitators and sample integrations. Early prototypes include:

-

x402-Express and x402-Next: middleware packages for integrating payment verification into popular JavaScript frameworks.

-

x402-MCP Adapter: connects the protocol to the Model Context Protocol (MCP), enabling AI models to pay for external context retrieval using stablecoins.

-

x402-Bazaar: a discovery index for paid APIs, showing available endpoints, accepted assets, and network metadata.

These projects demonstrate how quickly the protocol can spread when it aligns with existing development patterns. x402 requires minimal infrastructure and can work alongside traditional authentication and rate-limiting systems, which lowers the adoption barrier.

Institutional and Industry Interest

Several enterprises have shown interest in the standard for pay-per-use infrastructure and digital content delivery. Cloud and data providers view it as a potential billing layer for micro-access to APIs or datasets. Media publishers see it as a way to sell single-article access without relying on external platforms.

Because x402 defines only the handshake and verification schema, it can serve as the foundation for both enterprise-scale services and small open APIs. This flexibility is what sets it apart from previous payment protocols, which often required specialized networks or gateways.

Ecosystem Outlook

The x402 ecosystem remains young but strategically positioned. Its open governance through the x402 Foundation ensures that no single company controls its evolution. The combination of Coinbase’s reference implementation, Cloudflare’s web-scale deployment, and Google’s agent integration gives it credibility across the blockchain, web, and AI sectors.

If these collaborations continue, x402 could become a foundational part of how value flows across the internet. It offers a clear path from human commerce to automated, programmatic transactions while remaining compatible with existing HTTP infrastructure.

Risks and Open Questions

Every protocol that touches money must face questions of trust, governance, and real-world behavior. x402 is no exception. Its design achieves simplicity by staying close to HTTP, but that same simplicity leaves several areas of risk and uncertainty that will shape how the standard evolves.

Governance and Standardization

At launch, x402 is governed by the x402 Foundation, an initiative backed by Coinbase and Cloudflare. The foundation’s role is to maintain the open specification, test interoperability, and guide community contributions. While this structure is transparent and open to public input, it still depends heavily on a small set of founding organizations.

The success of x402 as a web standard will eventually require broader governance, similar to how W3C or IETF manage specifications. If the protocol remains primarily driven by private stakeholders, adoption may be limited to ecosystems they influence. Defining a neutral standards process, clear versioning, and compatibility guarantees will determine whether x402 becomes a true internet primitive or remains a proprietary convention.

Facilitator Concentration

Facilitators are central to x402’s usability. They verify, settle, and often subsidize transactions by paying gas on behalf of users. While the role is open and permissionless, network effects may naturally lead to concentration. Developers are likely to default to a few large facilitator providers that offer reliability and multi-chain support.

This dynamic mirrors the evolution of web infrastructure itself, where a handful of cloud and CDN companies handle most global traffic. The risk is not custodial capture, since facilitators cannot hold funds without authorization, but rather operational dependency. If facilitator APIs experience downtime or change policies, it could affect many integrated applications. Encouraging a diverse set of facilitators through open tooling and shared certification standards will be critical for long-term resilience.

Security and Replay Protection

The x402 design minimizes state by embedding verification data into each signed payload, but this shifts responsibility to implementers. Developers must correctly manage nonces, expiration timestamps, and unique payment identifiers. Any mistake could enable replay attacks or duplicate settlements.

The whitepaper recommends strict nonce tracking and short expiration windows, yet enforcement is left to each application. Without consistent reference implementations, security practices may diverge. Creating an open test suite or certification process for facilitators and SDKs could help maintain uniform security across implementations.

Economic Viability and Network Fees

x402 relies on stablecoins and low-cost settlement networks. Its microtransaction model works best when network fees are negligible. On expensive blockchains, small transactions could quickly become uneconomical. This risk is partially mitigated by Layer 2 solutions, batching, and facilitator-sponsored gas, but the underlying assumption of cheap execution remains.

If transaction costs rise, or if stablecoins face regulatory constraints that limit accessibility, the protocol’s usability could shrink to specific ecosystems. Ensuring that x402 can support multiple settlement rails, including non-crypto methods or synthetic stable assets, may be essential for sustainability.

Privacy and Data Handling

x402 does not include native privacy features. Payment payloads and verification data can reveal addresses, assets, and amounts. While most use cases involve public blockchains, there are scenarios where privacy is desirable, especially for enterprise or personal transactions.

Future extensions could integrate zero-knowledge proofs or encrypted payment headers to hide sensitive fields while keeping the verification flow intact. Until then, developers must design their own privacy safeguards at the application layer.

Regulatory Uncertainty

x402 operates at the edge between payment infrastructure and communication protocol. Because it standardizes the exchange of value over the web, it may draw scrutiny under existing financial regulations. The protocol itself is neutral and non-custodial, but facilitator services that execute on-chain transfers could fall under money transmitter or KYC/AML obligations depending on jurisdiction.

Clear guidelines for facilitator compliance will be necessary to avoid fragmentation. If regulators interpret facilitator operations inconsistently across regions, x402’s global interoperability could be undermined.

User Experience and Adoption Curve

For human users, the biggest challenge is not technology but experience. Most wallets today are not built for frequent microtransactions or automated payments. Even with gasless execution, constant confirmations or insufficient balances can disrupt usability.

AI agents and backend services avoid this problem by signing transactions programmatically, but mass-market adoption will require wallet improvements, allowance systems, and user education. Integrating x402 with ERC-4337 smart wallets and delegated spending models is one path forward, but these tools are still early in their lifecycle.

Open Questions

The following questions remain open for both implementers and researchers:

-

What level of facilitator decentralization is achievable in practice?

-

How should the ecosystem handle dispute resolution or chargebacks for on-chain transactions?

-

Can payment payloads be extended to include refunds, tips, or dynamic pricing?

-

How will the protocol evolve if browsers adopt native 402 support or standardized payment headers?

-

What governance model will ensure long-term neutrality without slowing development?

These questions will define the second phase of x402’s development. The protocol is technically complete but institutionally young. Its next milestones will involve less engineering and more coordination between stakeholders who want to make the web truly programmable for payments.

Closing Insights / TL;DR

x402 is a small protocol with large implications.

It gives the web a language for value exchange that is as simple and composable as the protocols that already move its data.

By turning the long-unused HTTP 402 status code into a standard for payments, it transforms an idea that has existed since the 1990s into a working mechanism for the modern internet.

At its core, x402 does not try to rebuild the financial system.

It focuses on what the web was missing: a shared, open handshake for requesting and confirming payments.

Everything else, from on-chain settlement to agentic automation, can be layered on top.

That restraint is what makes the design powerful.

It connects the logic of HTTP with the assurances of blockchain, allowing information and value to travel together in one loop.

The protocol’s simplicity makes it immediately usable.

Developers can add payments to any endpoint with a few lines of code.

Facilitators abstract the blockchain layer for those who want convenience, while advanced teams can self-host for full control.

The cost of entry is low, and the benefits are structural.

Once a resource can respond with 402 Payment Required, the entire economic relationship between web clients and servers becomes programmable.

The open questions remain: governance, facilitator decentralization, and long-term user experience.

But the foundation is solid.

HTTP now has a payment grammar, and it works across humans, APIs, and agents alike.

If HTTP made the web readable, and REST made it programmable, x402 may be what finally makes it payable.

Sources and Further Read

-

X402. x402: An Open Standard for Internet-Native Payments, Whitepaper, May 6 2025. https://www.x402.org/x402-whitepaper.pdf

-

Coinbase. x402 GitHub Repository, 2025. https://github.com/coinbase/x402

-

Fielding, R. et al. Hypertext Transfer Protocol — HTTP/1.1 (RFC 2616), IETF, 1999. https://www.rfc-editor.org/rfc/rfc2616

-

Buterin, V. et al. EIP-712: Ethereum Typed Structured Data Hashing and Signing, 2017. https://eips.ethereum.org/EIPS/eip-712

-

Interledger Foundation. Interledger Protocol Specification (IL-RFC-0001), 2017. https://interledger.org/rfcs/0001-interledger-protocol/

-

Lightning Labs. LSAT (Lightning Service Authentication Tokens) Overview, 2020. https://lightning.engineering/posts/2020-03-30-lsat/

-

Stripe Documentation. API Overview, 2024. https://stripe.com/docs/api

-

Ethereum Foundation. ERC-4337: Account Abstraction via Entry Point Contract Specification, 2023. https://eips.ethereum.org/EIPS/eip-4337

-

Cloudflare. Introducing the x402 Foundation, 2025. https://blog.cloudflare.com/

-

Google. Agent Payments Protocol (AP2) Overview, 2025. https://developers.google.com/agent-payments