Executive Summary

This article includes three summaries written for different types of readers:

🟦 For the Curious: New to crypto or just exploring? Start here.

🟨 For the Enthusiast: Know your staking from your slashing? This is for you.

🟥 For the Builder / Founder: Deep dive into system design, trade-offs, and strategic context.\

Choose the one that best matches your background or read them all for a layered understanding.

🟦 For the Curious (Beginner)

What is Berachain, and why does it matter?

Imagine if only landlords made money in a city, while the people running stores and restaurants paid rent but got little in return. That’s how many blockchains work today. The people securing the network, called validators — get rewarded just for locking up money, while the applications actually driving activity often struggle to survive.

Berachain wants to flip that model. It’s a new kind of blockchain that rewards the apps and users who actually bring the system to life. Instead of paying validators for sitting on tokens, it rewards them for helping grow real activity, like providing liquidity or using DeFi apps. This is done through a system called Proof-of-Liquidity, which turns block rewards into a kind of marketplace where dApps compete for attention and users get rewarded for participating.

Think of it like a city where the more people visit your store, the more tax breaks you get and landlords only make money if their tenants thrive.

It’s still early, and this model is complex, but if it works, it could reshape how new blockchains grow, by making builders, users, and infrastructure share in the upside together.

🟨 For the Enthusiast (Intermediate)

Berachain is an EVM-compatible Layer 1 blockchain that introduces a novel consensus mechanism called Proof-of-Liquidity (PoL). Instead of paying staking rewards to idle token holders, Berachain issues rewards through a marketplace of Reward Vaults, where validators must direct emissions toward active protocols. These vaults incentivize productive behaviors like LPing or lending, and protocols can offer bribes to attract more emissions. Users earn a governance token ($BGT) by participating, which they can delegate to boost validators or burn to exit the system.

This creates a feedback loop: validators compete for boost, protocols compete for emissions, and users get rewarded for helping allocate block rewards effectively. The architecture also includes three tokens:

- $BERA for gas and staking (slashable)

- $BGT for governance and boosting (non-transferable)

- $HONEYas a native stablecoin for DeFi use

Berachain runs on BeaconKit, a modular consensus framework that wraps CometBFT with Ethereum’s Engine API to enable fast finality, optimistic execution, and 100% EVM identicality, not just compatibility. This means existing Ethereum tools work out of the box.

Compared to traditional PoS chains, Berachain aims to realign incentives by rewarding usage over lock-up. The trade-off is added complexity; both technically and economically and reliance on continued dApp engagement to sustain validator income.

🟥 For the Builder / Founder (Advanced)

What does Berachain optimize for, and how does it fit into current infra trends?

Berachain is a consensus-layer experiment designed to realign economic incentives in PoS systems. Its Proof-of-Liquidity model introduces a structurally enforced marketplace between validators, protocols, and users. Validators receive emissions in $BGT, which must be allocated to whitelisted vaults tied to productive activity. Protocols bid for these emissions using native tokens (bribes), while users earn $BGT by participating and can delegate it to boost validators or burn it 1:1 for $BERA.

The core economic shift:validator profitability becomes usage-dependent.This is an intentional response to the Fat Protocol Thesis, attempting to retain more value within the application layer and making validators accountable for ecosystem health. Compared to designs like EigenLayer or restaking protocols, Berachain enforces this dynamic at the consensus level.

Technically, Berachain’s BeaconKit enables unmodified Ethereum execution clients (e.g., Geth, Reth) to run on top of CometBFT. This delivers fast finality, EVM identicality, and modularity — including support for custom block builders and application-specific logic. Minor forks (bera-geth, bera-reth) were introduced with BRIP-0004 to support reward distribution within execution blocks.

Trade-offs include: added economic and architectural complexity, governance dependency, and validator cartel risks. The system assumes continuous protocol demand for emissions; if that demand collapses, the model reverts to quasi-PoS.

Berachain’s design is best suited to ecosystems with active DeFi protocols that can integrate with vaults. Builders benefit from Ethereum-grade tooling and liquidity incentives, but must internalize the cost of bootstrapping emissions. Long-term viability depends on protocol diversity and governance resilience.

Introduction

Validator incentives in Proof-of-Stake (PoS) blockchains have long been misaligned with network growth. Validators are rewarded for locking up tokens, not for supporting real on-chain activity like liquidity provisioning or lending. This dynamic can starve ecosystems of capital and encourage passivity over participation.

TheFat Protocol Thesis, first introduced by Joel Monegro in 2016, quickly became a canonical framework in crypto. It introduced the idea of “fat protocols and thin apps” a reversal of the Web2 dynamic. In Web2, applications like Facebook, Snapchat, and Spotify captured the vast majority of value, while the internet protocols they relied on (like HTTP or TCP/IP) remained commoditized and value-neutral. But in crypto, Monegro observed a shift: blockchain protocols (like Ethereum) were capturing more aggregate value than the applications built on top of them.

This thesis was prescient. Since then, most of the market capitalization and attention in Web3 has concentrated at the protocol layer, L1s and L2s, while many dApps have struggled to retain value or build sustainable business models.

But herein lies a challenge. Web3 doesn't need yet another L1 or L2, it needs great applications. And those applications increasingly operate in an environment where they pay “rent” to the underlying protocol, whether via gas fees or MEV exposure, while validators and block producers extract the lion’s share of value. Without realignment, the ecosystem risks repeating the centralization patterns of Web2, just with different rent collectors.

Berachain, a new EVM-compatible Layer 1 built on the Cosmos SDK, proposes an alternative: Proof of Liquidity (PoL). By directing inflationary rewards to liquidity providers rather than token holders, Berachain aims to make validator security and ecosystem usage mutually reinforcing. This article explains how Berachain’s architecture works, how its tri-token model reshapes incentives, and what trade-offs it introduces compared to standard PoS designs.

How It Works?

Proof of Liquidity: Incentives That Follow Usage

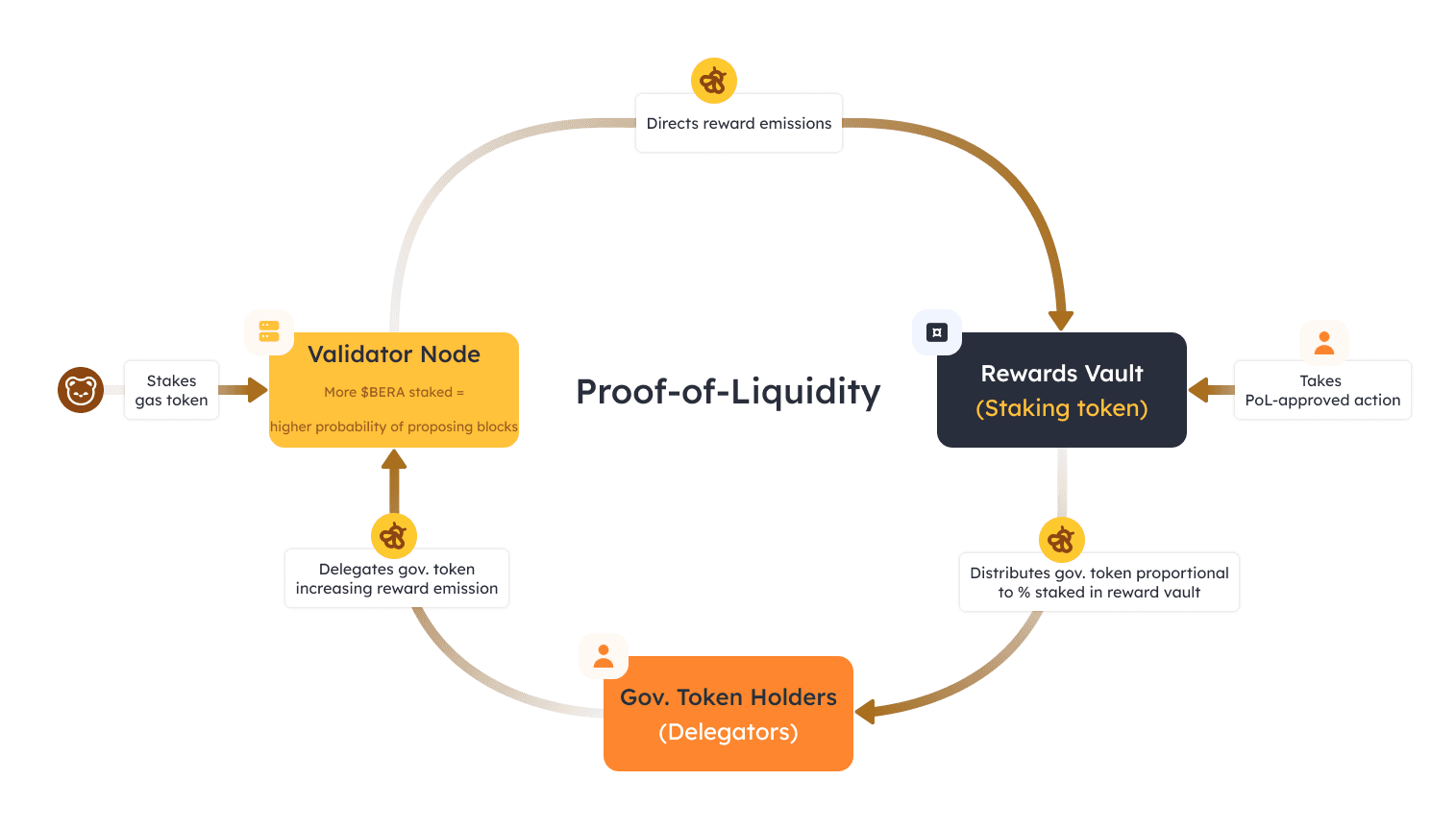

Berachain replaces traditional staking rewards with a market-based reward cycle called Proof of Liquidity (PoL). Instead of emitting block rewards directly to validators or delegators, Berachain issues a governance token called $BGT, which validators must distribute to Reward Vaults. These vaults incentivize users to provide liquidity or perform other productive actions.

Here’s how the cycle works:

- Validators stake $BERA to enter the active set (top 69 by stake).

- When selected to produce a block, a validator receives:

- A base emission of $BGT (fixed amount)

- A vault-directed emission, which must be allocated across whitelisted Reward Vaults

- Protocols can deposit whitelisted incentive tokens into these vaults (bribes).

- Validators choose which vaults to fund and receive bribes in return.

- Users stake PoL-eligible tokens (e.g., LP or lending receipts) in those vaults to earn $BGT.

- $BGT holders boost validators, increasing their future $BGT allocation.

- Validators distribute some of their bribes back to $BGT boosters.

- Any $BGT holder may burn $BGT 1:1 for $BERA to exit the system.

This creates a closed-loop economy where validator profitability depends on:

- Size of $BGT boost (from users)

- Bribe yield from protocols

- Commission rate set on shared incentives

Source: https://docs.berachain.com/learn/what-is-proof-of-liquidity

Source: https://docs.berachain.com/learn/what-is-proof-of-liquidity

Token Roles and Flows

Berachain uses a Two-Token model, for the Proof-of-Liquidity consensus:

- $BERA: The gas and staking token. It secures the network through validator bonding and is used to pay transaction fees. $BERA is the only slashable token in the protocol.

- $BGT: The governance and rewards token. It is non-transferable and can only be earned via block rewards (validators) or reward vault participation (users). $BGT is used to boost validators and to vote in on-chain governance.

Native stablecoin for defi:

- $HONEY: An overcollateralized stablecoin pegged to USD. It is minted through vaults and used in Berachain-native DeFi protocols.

$BGT plays a central role in coordinating validator selection and reward distribution. It can be delegated to validators (boosting their emissions), used to vote on protocol governance, and redeemed 1:1 for $BERA. However, once burned for $BERA, it cannot be reacquired by converting back, users must earn new $BGT by providing liquidity or participating in whitelisted activities.

$HONEY acts as the protocol’s internal unit of account for trading and borrowing. It is not directly involved in Proof of Liquidity mechanics, but it circulates within vaults and native dApps and supports economic activity across the chain.

Boost Mechanics and Emission Formula

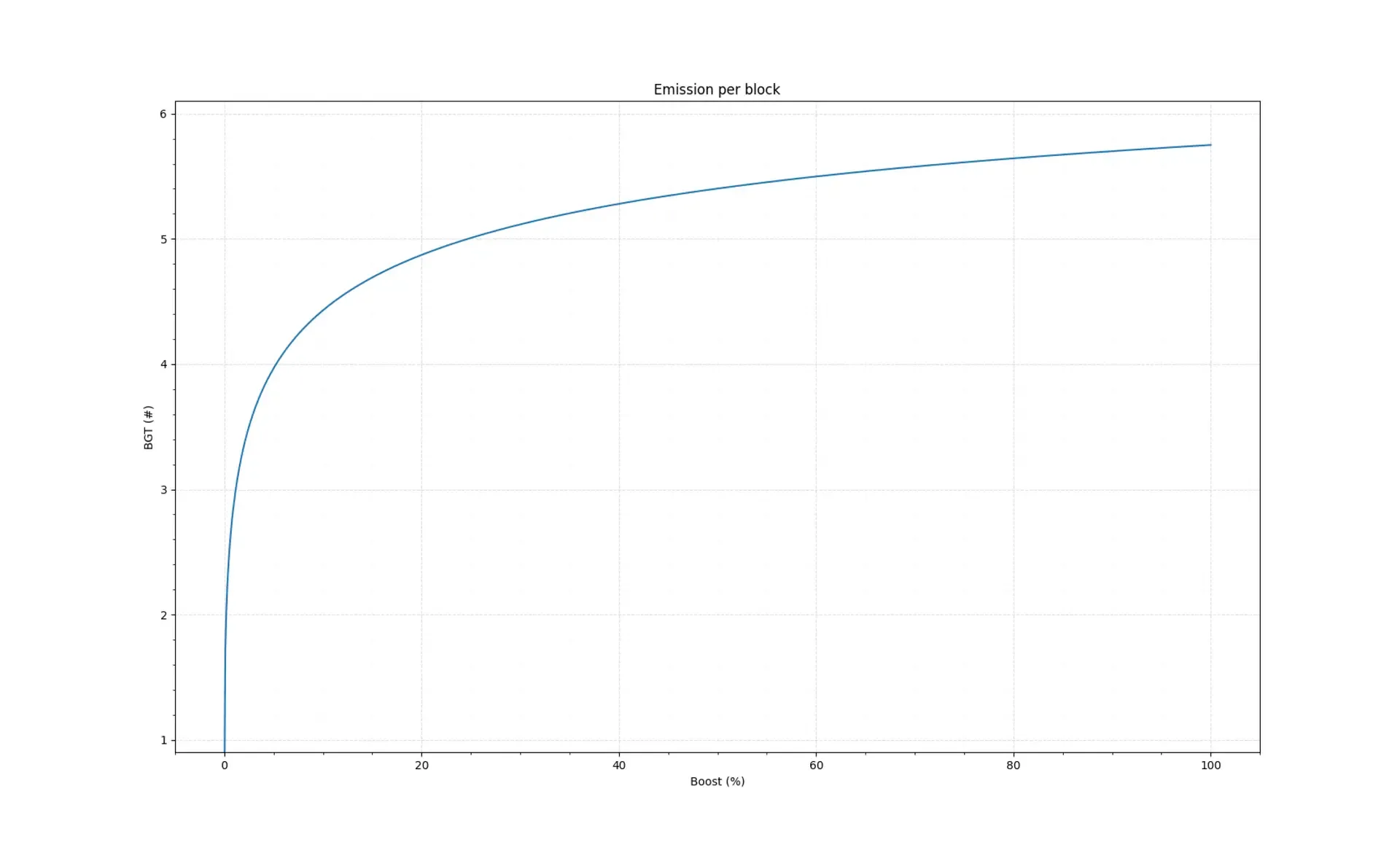

Each validator’s boost ratio x determines their share of the total $BGT emissions. The higher the boost, the more emissions they control, but returns scale concavely to encourage decentralization.

Source:https://honeypaper.berachain.com/

Source:https://honeypaper.berachain.com/

Validators with zero boost get only the base reward B. As the amount of $BGT delegated increases, vault-directed emissions rise quickly, then flatten. This discourages whales from dominating boost.

Redemption and Market Equilibrium

$BGT can always be burned 1:1 for $BERA, providing an exit option and floor value. This mechanism helps balance supply and demand:

- If protocol bribes are high, users farm $BGT to boost validators and earn shared incentives.

- If bribes dry up, or $BGT emissions outpace demand, users burn $BGT for $BERA.

- This shrinks supply, concentrates rewards among fewer holders, and restores equilibrium.

Unlike protocols like Curve or Solidly, PoL’s emissions are endogenous, block rewards must be issued to maintain consensus, but only create economic value if validators allocate them well.

One of the most important stabilizers in Berachain’s incentive system is the 1:1 redemption mechanism between $BGT and $BERA. Any $BGT holder can burn their tokens to receive $BERA at a fixed rate, effectively exiting the PoL economy.

This redemption flow introduces a self-regulating market mechanism:

- When application incentives are strong, $BGT holders are better off boosting validators and earning shared bribes. The opportunity cost of burning $BGT is high, so users retain and accumulate it, increasing system liquidity and vault participation.

- When incentive yield falls below the rate of $BGT issuance, users start redeeming $BGT for $BERA. This reduces circulating $BGT and the number of claimants on emissions, increasing the per-BGT yield for remaining participants.

This push-pull dynamic continuously nudges the system toward equilibrium. It ensures that block rewards are only as attractive as the economic value they drive. Unlike models like Curve or Solidly, where inflation is exogenous and tied to external vote escrow mechanics, Berachain’s inflation is endogenous, driven by its consensus requirements.

Notably, Berachain does not increase inflation when $BGT is redeemed. The emissions follow a PoS-like schedule, and burning $BGT just reduces the active supply. In a theoretical extreme where all $BGT is redeemed, the chain would revert to a standard PoS model, same issuance, but no incentive routing through PoL.

Vaults and Incentives Marketplace

Each reward vault is associated with a PoL-eligible asset (e.g., LP token) and a whitelisted incentive token. Validators allocate emissions toward vaults by weight. Protocols can adjust the incentive exchange rate e.g., "10 protocol tokens per 1 $BGT received."

If a validator sends x $BGT to a vault, and the current rate is p, the validator receives p·x worth of protocol tokens. These incentives are typically split between the validator and their $BGT boosters.

Vaults and incentive tokens must be whitelisted through on-chain governance.

Architecture: How It’s Built

Berachain is built on BeaconKit, a modular framework for building EVM consensus clients using the CometBFT consensus engine. This architecture allows Berachain to be both EVM-identical and benefit from fast finality, reduced block times, and modular extensibility.

BeaconKit

BeaconKit is a modular consensus framework developed by Berachain to support high-performance, EVM-identical blockchains. Unlike traditional Cosmos-based chains or EVM-compatible solutions, BeaconKit allows chains to run standard, unmodified Ethereum execution clients (like Geth, Reth, Nethermind, and Erigon) on top of the CometBFTconsensus engine — without breaking Ethereum tooling or developer experience.

It does this by wrapping CometBFT with a middleware layer that implements Ethereum’s Engine API, effectively mirroring Ethereum’s own separation of consensus and execution layers. This design achieves 100% EVM identicality, not just compatibility, meaning developers can use the same libraries, languages, and testing frameworks as on Ethereum mainnet.

Key technical benefits include:

- Single Slot Finality (SSF): Blocks finalize in one round, unlike Ethereum’s 13-minute delay

- Optimistic Payload Building: Block execution is parallelized with consensus voting, reducing block times by up to 40%

- Immediate Execution: Allows validators to sign the state root before accepting a block, enabling fast confirmation

- EIP Compatibility: Integrates upgrades like EIP-4788 for trustless consensus data in the execution layer

- Modularity: Enables custom block builders, rollup support, and non-standard state logic

- Sustainability: Avoids client forks by keeping execution logic in upstream Ethereum clients, easing long-term maintenance

BeaconKit is what enables Berachain to run forked but minimal variants of Ethereum clients (like bera-geth and bera-reth) and still achieve fast, deterministic finality and seamless EVM support. It positions Berachain not just as an L1, but as a framework for building EVM-native L2s and application-specific chains with Ethereum-grade tooling and performance.

EVM Identicality & Execution Clients

Berachain’s execution layer used to rely on fully unmodified EVM clients. However, with BRIP-0004, Berachain introduced a minimal but critical change: enshrining the distributeFor function into the execution layer. This enables automatic reward fulfillment at the beginning of each block, no need for bots or extra transactions.

This change required minimal forks of the Geth and Reth clients (now called bera-geth and bera-reth). Thanks to BeaconKit’s clean separation of consensus and execution, these changes remain isolated and sustainable.

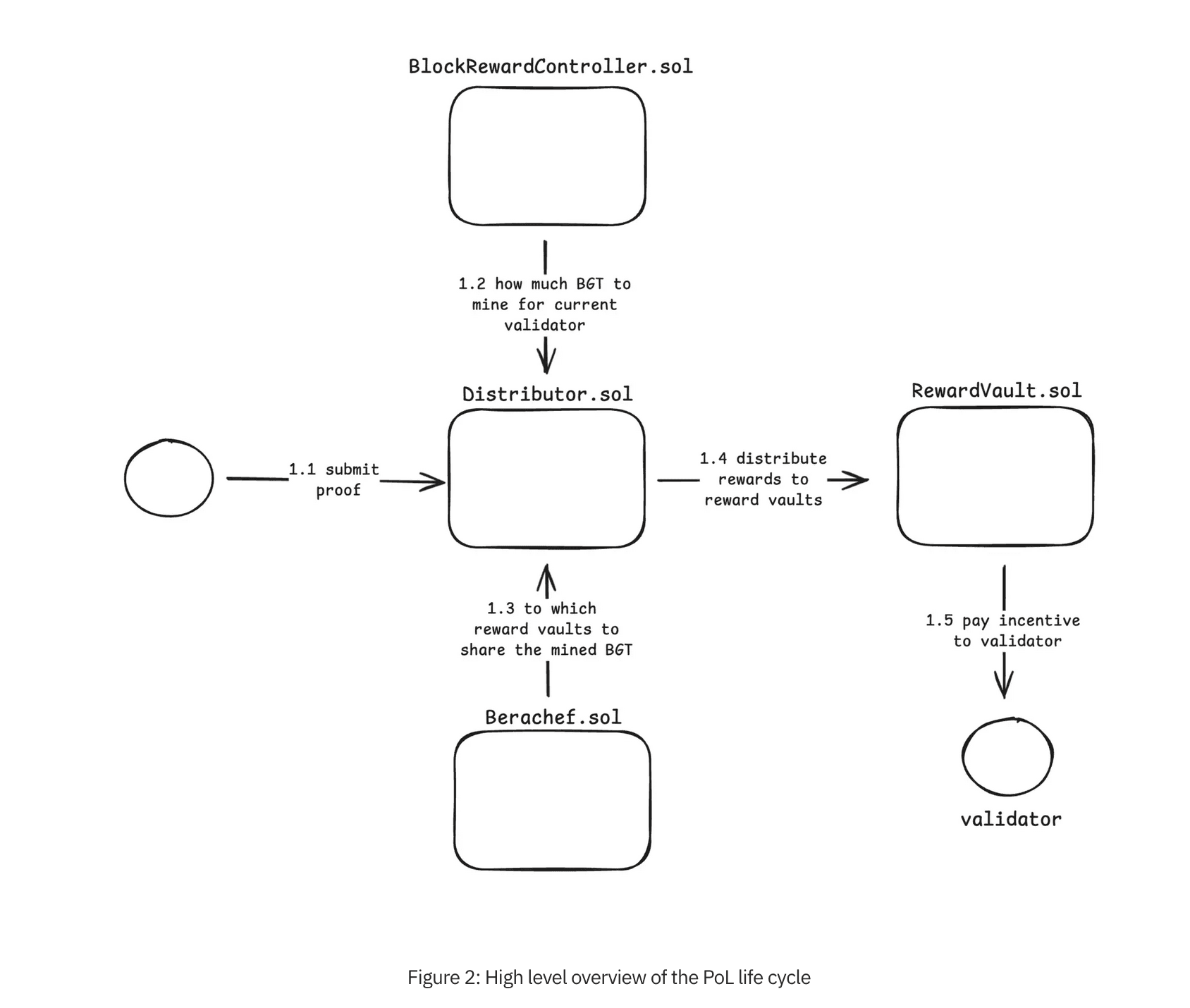

Protocol Execution and Reward Lifecycle

PoL is not just an economic model — it replaces the entire incentive mechanism within block production. As such, it requires a tight link between the consensus and execution layers.

This link is established through the use of EIP-4788, which makes beacon block roots available to the execution environment. In each block, the consensus layer posts the validator's public key and block metadata, allowing the PoL system to deterministically credit validators and initiate reward distribution.

Source: https://honeypaper.berachain.com/

Source: https://honeypaper.berachain.com/

Here’s what happens at block runtime:

- Proof: Prove that the validator in question proposed a block using the beacon block root.

- Reward Calculation: The block rewards controller controls the inflation per block and matches with the BGT boost how much BGT to mint for the current validator.

- Vault Allocation: The validators have a choice of the set of reward vaults and their weighting.

- Emission: Allocated $BGT emissions are forwarded to vault contracts.

- Compensation: Protocol incentives are routed to validators and their $BGT boosters.

This execution path ensures rewards are distributed trustlessly, automatically, and in real time, removing the need for bots or separate distribution transactions.

Design Decisions and Trade-offs

Economic Design and Incentive Realignment

Berachain optimizes for a dynamic, usage-driven economy by tightly coupling validator rewards with real economic activity. Unlike typical PoS systems where inflation is distributed blindly to stakers, Berachain routes rewards through a marketplace, validators must earn their compensation by directing inflation to vaults that provide value.

This model discourages idle capital and promotes ecosystem growth. However, it also means validator income is volatile and dependent on external protocol incentives. If no dApps are bidding for emissions, validator returns drop significantly.

Complexity vs. Usability

The protocol introduces substantial complexity across both technical and economic layers. The two-token system, reward vaults, emission weights, boosting, and burn mechanics are unfamiliar concepts to most users and developers.

This design is powerful but non-intuitive. Users must understand multiple roles ($BGT booster, $BERA staker, vault LP) to optimize yield. Misconfigurations or misunderstanding vault parameters could lead to misaligned incentives or capital loss.

Security and Governance Assumptions

Only $BERA is slashable, meaning network security is backed solely by $BERA stake. Boosted validators carry no economic risk from misbehavior. This separation improves user experience but may reduce total value at risk securing the network.

Governance also plays a critical role. Vaults, incentive tokens, and emission settings are all whitelisted via $BGT voting. If governance is captured or manipulated (e.g., malicious vault approved), it could skew reward flows or compromise system integrity.

Centralization Vectors

PoL introduces economic competition between validators based on boost and bribe efficiency. Validators that dominate bribe aggregation and LP targeting may accrue more $BGT boost over time, potentially leading to validator centralization. Although emissions scale concavely with boost, these dynamics should be monitored closely.

The End of PoL

PoL relies on active participation across validators, protocols, and users but there are scenarios where this balance can break down.

One potential failure mode is if validators collude to set extremely high commissions (e.g. 100%) on protocol incentives. This would eliminate the yield for $BGT boosters, likely causing them to exit the system by burning $BGT for $BERA. As booster participation drops, protocols may stop competing for emissions, undermining the incentive loop and pushing the system toward a fallback PoS model.

Another risk comes from external yield shocks. For instance, if a spike in $BERA lending rates occurs due to speculative activity or an airdrop campaign, validators and $BGT holders might prefer lending over staking or boosting. This would reduce $BERA staked and shrink active validator capacity.

In both cases, Berachain includes counterbalancing incentives. The PoL emission curve penalizes validators with low boost, limiting their ability to direct emissions. A validator that breaks from cartel behavior and lowers its commission could quickly capture most of the available boost. Similarly, as $BGT is burned and the booster base shrinks, the incentive rate for remaining $BGT holders increases gradually restoring equilibrium.

These dynamics make PoL fragile under certain conditions but also self-correcting in theory, assuming rational actors and sufficient protocol diversity.

Ecosystem and Go-To-Market

Native Apps and Protocol Stack

Berachain launched with a suite of integrated DeFi primitives built to demonstrate and bootstrap its Proof-of-Liquidity model:

- BEX: A native DEX inspired by Balancer, supporting multi-token pools, MetaPools, and dynamic vault integration.

- Bend: A lending protocol that enables borrowing and lending against $HONEY and other assets, integrated into vault emissions.

- Berps: A perpetuals exchange offering leverage trading, with vault-driven rewards for liquidity and activity.

- Honey: Berachain's native overcollateralized stablecoin, used throughout the ecosystem for swaps, loans, and settlements.

These apps are tightly coupled with PoL and serve as primary consumers of vault rewards and sources of incentive bribes.

Bootstrapping Adoption

Berachain grew out of the Bong Bears NFT community, leveraging meme culture and community coordination to generate early attention. The protocol launched a public testnet in 2024 to refine PoL mechanics and gauge user behavior.

Airdrops of $BERA and reward vault eligibility were used to seed early participants. Vault-based rewards for testnet contributions and liquidity mining bootstrapped usage, while early governance proposals shaped vault whitelisting and incentive rates.

Validators and staking infrastructure providers, including Chorus One and Figment, participated from the early stages, helping test validator optimization strategies under PoL.

Developer Experience and Tooling

Berachain is EVM-identical, meaning developers can deploy Solidity contracts using standard tools like Hardhat, Foundry, Metamask, and Ethers.js.

Developers can build:

- Custom dApps that plug into PoL vaults

- New vaults for existing or new tokens (pending governance approval)

- Protocols that use $HONEY or integrate BGT-boosting mechanics

Documentation and SDKs are actively maintained, and developer onboarding is streamlined compared to most Cosmos chains thanks to full EVM compatibility.

Funding and Positioning

Berachain raised a $42M Series A in 2023, led by Polychain Capital, with participation from Tribe Capital, Shima Capital, and Hack VC and a $100M Series B in 2024 kead by Brevan Howard DigitalCrypto Fund. Its strategy focuses less on raw TPS and more on economic alignment, positioning itself as a “fat protocol” that channels block rewards to dApps instead of idle stakers.

Unlike many chains, Berachain doesn’t just offer fast execution, it tries to hardwire economic utility into its reward mechanism. This positions it as a base layer optimized for liquidity-first protocols, and an alternative to yield-split PoS models where validators and apps are economically siloed.

Risks, Debates, and Open Questions

Despite its elegant incentive design, Berachain’s PoL model introduces new risks and uncertainties that are still being tested in practice.

Unproven Economic Assumptions

PoL assumes a consistent demand for validator-directed emissions, that protocols will compete for $BGT allocation and users will boost validators in return. But in down markets or periods of low dApp activity, that demand could dry up. Without meaningful bribes, validator income may collapse, breaking the reward loop.

Governance Capture

Berachain governance depends on $BGT holders whitelisting vaults and incentive tokens. If early boosters, protocols, or whales dominate governance, they could skew emissions toward preferred projects or attack reward integrity. Because $BGT is non-transferable, governance power is earned, not bought — but distribution still risks centralization.

Parameter Fragility

PoL relies on concave emission curves and protocol-level reward math. Small misconfigurations e.g., too weak a penalty for low boost, or overly generous vault incentives, could distort behavior or create perverse incentives. Adjusting these parameters requires governance coordination and robust analytics.

Validator Cartels and the “End of PoL”

If validators collude to set 100% commissions, they could extract all rewards and drive $BGT boosters to burn their tokens for $BERA. This would reduce vault activity and potentially revert the system to a de facto Proof-of-Stake model. While game theory suggests a rational validator would undercut the cartel to win boost, the system’s resilience depends on real-world behavior, not theory.

External Shocks and Exit Pressure

Sharp increases in $BERA lending rates or speculative activity could incentivize both validators and users to exit PoL — either by unstaking or burning $BGT. If this happens en masse, the chain may experience a temporary collapse in boost coverage and emissions flow. The design includes self-correcting feedback loops (burn reduces supply, increasing per-BGT returns), but it assumes actors are responsive and long-term aligned.

Final Thoughts / TL;DR

Berachain is a Layer 1 chain designed to solve an overlooked problem: validator rewards that don’t reflect real usage. Instead of rewarding idle stake, its Proof-of-Liquidity model redirects emissions to users and dApps that create value — with validators competing to allocate inflation efficiently.

Backed by a two-token system and built on a modular EVM-identical stack (BeaconKit + CometBFT), Berachain delivers fast finality and a familiar developer experience while introducing fundamentally new economic mechanics.

The big idea: rewards flow to liquidity, not to lockup. But with that comes risk — PoL is more complex, less predictable, and dependent on ecosystem participation. Whether it becomes a new baseline for L1 economics or collapses under coordination pressure will depend on how well its incentives perform at scale.

For now, it’s one of the most technically ambitious attempts to realign validator incentives with on-chain activity.

Sources

- Joel Monegro – Fat Protocols

- David Phelps – The Fat App Thesis

- Berachain – The Fat Bera Thesis

- Berachain – Honeypaper: Proof-of-Liquidity Overview

- Berachain - Berachain docs

- Berachain - BRIP-0004: Enshrined Proof of Liquidity Reward Distribution

- Ethereum - EIP-4788: Beacon block root in the EVM

- Codebyankita - Deep Dive into Proof of Liquidity: Berachain’s Game-Changing Consensus Mechanism