Executive Summary

This article includes three summaries written for different types of readers:

🟦 For the Curious: New to crypto or just exploring? Start here.

🟨 For the Enthusiast: Know your staking from your slashing? This is for you.

🟥 For the Builder / Founder: Deep dive into system design, trade-offs, and strategic context.

Choose the one that best matches your background, or read them all for a layered understanding.

🟦 For the Curious (Beginner)

Why do decentralized exchanges look so different from centralized ones? Until now, most crypto trading on-chain used something called AMMs (Automated Market Makers). These are pools of tokens that set prices with a simple formula. They’re easy to use and always give you a price, but they can be inefficient, especially for big trades.

Traditional markets like stocks use order books, where buyers and sellers post their prices and trades happen when they meet. Early blockchains like Ethereum were too slow and expensive to support this model. That’s why AMMs became the default in crypto.

Now the tech has caught up. New blockchains and rollups can process thousands of transactions per second, fast enough to run order books again. Projects likeHyperliquid, dYdX, Aevo, and Vertexare bringing this model back, offering more precise trading and advanced features like limit orders and stop-losses.

In simple terms: AMMs got DeFi started. But order books are returning, and they could make decentralized trading feel a lot more like Coinbase or Binance, just without giving up control of your funds.

🟨 For the Enthusiast (Intermediate)

AMMs defined DeFi because Ethereum couldn’t support order books. Pools and pricing curves allowed anyone to provide liquidity, bootstrap new markets, and trade with a single transaction. But they’re capital-inefficient and limited in functionality.

CLOBs (Central Limit Order Books) solve those inefficiencies by concentrating liquidity at specific price levels and supporting advanced order types. The challenge was always infrastructure: order placement and cancellation require fast, cheap throughput, something Ethereum L1 could never provide.

Today, new execution environments make CLOBs viable:

- High-performance chains(e.g. Hyperliquid L1, Solana) can host fully on-chain books.

- App-chains(dYdX v4 on Cosmos) let validators maintain order books in memory and gossip orders peer-to-peer.

- Rollup + DA hybrids(Aevo on Optimism + Celestia) separate execution, settlement, and data for cheap scalability.

- Hybrid AMM+OB models(Vertex on Arbitrum) combine on-chain pools with off-chain books for resiliency.

Each model balances speed, decentralization, composability, and fairness differently. The core trade-off is clear: AMMs optimized for Ethereum’s limitations, while CLOBs optimize for efficiency in higher-performance environments.

🟥 For the Builder / Founder (Advanced)

The re-emergence of CLOB-native DEXs is not just a product shift but an architectural turning point. AMMs solved the constraints of Ethereum L1: low TPS, high latency, and high gas costs. But they locked DeFi into models with high slippage, poor capital efficiency, and limited order logic.

CLOBs are now viable thanks to:

- Consensus improvements (sub-second block times, app-specific PoS validators).

- Rollups and modular DA (separating execution, settlement, and availability).

- Validator-based in-memory books (dYdX’s

memclobdesign). - Hybrid liquidity models (AMM fallback as “slow mode” in Vertex).

Case studies highlight different positions on the spectrum:

- Hyperliquid maximizes performance with a fully on-chain book, trading off validator decentralization.

- dYdX v4 decentralizes matching across validators, but loses Ethereum composability.

- Aevo leverages rollup modularity and yield-bearing collateral but retains a centralized matching engine.

- Vertexbalances composability with resiliency, but complexity and sequencer centralization remain risks.

The open questions are:

- Can matching engines be decentralized without breaking latency?

- Will cross-chain liquidity aggregation solve fragmentation?

- How much fairness (batch auctions, encrypted order flow) will traders accept if it slows execution?

Key takeaway for builders: AMMs and CLOBs are now complementary, not mutually exclusive. CLOBs dominate “fat-tail” high-volume markets where efficiency and advanced order types matter. AMMs remain best for “long-tail” assets and bootstrapping liquidity. Hybrid designs suggest the next generation of DEXs may blend the two.

Introduction – Why DEX Design Is Being Revisited in 2025

The story of decentralized exchanges is one of constant reinvention.

Back in 2016, the first experiments like EtherDelta tried to bring the order book model of traditional finance onto Ethereum. It worked in principle, but in practice every order, every cancellation, every trade was a blockchain transaction. Fees piled up, confirmations took minutes, and order books were thin and fragile. Even with follow-ups like IDEX and 0x relayers, DEXs remained slow, clunky, and mostly used by power users. For everyone else, centralized exchanges like Binance or Coinbase were simply better.

That changed with the arrival of Automated Market Makers (AMMs). When Uniswap v1 launched in 2018, it introduced a new idea: let liquidity live in a pool, not in a book of orders. Prices would be set by a simple equation, not by waiting for someone else to place the right order. Suddenly, trading didn’t require active market makers or constant order updates. By 2020, with Uniswap v2 and Curve, AMMs had become the backbone of DeFi. Anyone could provide liquidity, anyone could trade instantly, and during DeFi Summer 2020, billions flowed through AMM-based protocols.

But the story doesn’t end there. AMMs solved the problems of their time - slow chains, high fees, and thin liquidity, but they came with trade-offs: capital inefficiency, limited order types, and unavoidable slippage on large trades. Traders and builders knew that order books were still the gold standard for efficiency and precision; they just weren’t possible on-chain.

Now, nearly a decade after EtherDelta, the infrastructure has finally caught up. High-performance chains, Layer-2 rollups, and modular data layers have created an environment where Central Limit Order Books (CLOBs) are viable again. And in 2023–2025, projects like Hyperliquid, dYdX v4, Aevo, and Vertex are proving it: delivering near–CEX speed with on-chain settlement and self-custody.

The return of order books marks a new chapter for DEXs. To understand why it matters, we need to retrace the path: why AMMs emerged, why order books were abandoned, and why they’re back now - reshaping the landscape once again.

Why AMMs in the First Place

When Ethereum made programmable blockchains possible, decentralized trading was one of the first ideas people tried. But early DEXs quickly ran into a wall: Ethereum simply couldn’t handle the demands of an order book. Every order, every cancellation, every tiny update had to be mined into a block. Imagine trying to run a stock exchange where every trader has to stand in line at city hall to notarize their bid—it was never going to scale.

The breakthrough came with Uniswap’s Automated Market Maker (AMM) in late 2018. Instead of a fragile order book that needed constant updates, Uniswap pooled liquidity and let a simple formula: x * y = k - set the price.

That meant:

- No waiting for a counterparty. Anyone could swap against the pool instantly.

- No professional market makers needed. Anyone could deposit tokens and earn fees.

- No empty markets.There was always a price, even if it wasn’t great.

This was radical. For the first time, trading didn’t depend on a handful of market makers showing up, it depended on math. By 2020, as Uniswap v2 and Curve hit their stride, AMMs became the backbone of DeFi. They weren’t perfect, capital often sat idle in wide ranges, and large trades moved prices sharply, but they worked under Ethereum’s harsh constraints. Without AMMs, DeFi Summer simply wouldn’t have happened.

Why We Couldn’t Have CLOBs Then

Order books never disappeared from the conversation. Traders knew they were more efficient: they allow precise control, advanced order types, and near–zero slippage if liquidity is deep. But in the early years of Ethereum, CLOBs were simply not viable. The problem wasn’t the concept, it was the infrastructure.

Latency: Ethereum blocks took ~13 seconds to confirm. On a CEX, an order appears in the book instantly; on-chain, traders had to wait half a minute just to see a bid land. By the time it confirmed, the market had already moved. For active trading, that delay was fatal.

Throughput: A healthy order book requires thousands of updates per second. Ethereum 1.0 could handle ~15 transactions per second globally. That bandwidth had to serve all dApps, not just DEXs. If every order and cancellation was on-chain, the network would be overwhelmed instantly.

Gas costs: Each interaction was a transaction. Placing a bid cost gas. Canceling it cost gas. Updating it cost gas. Market makers, who normally cancel and repost dozens of orders per second, couldn’t operate under that model. Even casual traders were deterred when canceling a stale order cost more than the trade itself.

Liquidity gaps: Because it was expensive and slow, few traders wanted to post limit orders. Most books sat half-empty, with huge gaps between bids and asks. A new trader logging in would see wide spreads and no depth. The market looked broken, and in a way, it was.

Mempool dynamics: To make matters worse, orders sat visible in Ethereum’s mempool while waiting to be mined. Bots could see a large order coming and front-run it, further degrading the user experience.

The result was predictable: on-chain order books like EtherDelta and IDEX became unusable for most traders. Hybrid attempts like 0x relayers tried to move the book off-chain and only settle trades on-chain, but they couldn’t solve the fundamental issue, Ethereum wasn’t built for high-frequency order matching.

This is why AMMs took off. They sidestepped all of these problems with a design that required just one transaction per trade, no cancellations, and no dependency on market makers. AMMs weren’t better in theory, they were better in practice, given the limits of the time.

How CLOBs Work in DeFi (Simplified)

At its core, a Central Limit Order Book (CLOB) is nothing new. It’s the model that underpins nearly every stock, bond, and futures exchange in the world. Two lists — one of buy orders (bids) and one of sell orders (asks) — matched whenever prices overlap. What’s new in DeFi iswherethat book lives andhowit’s updated.

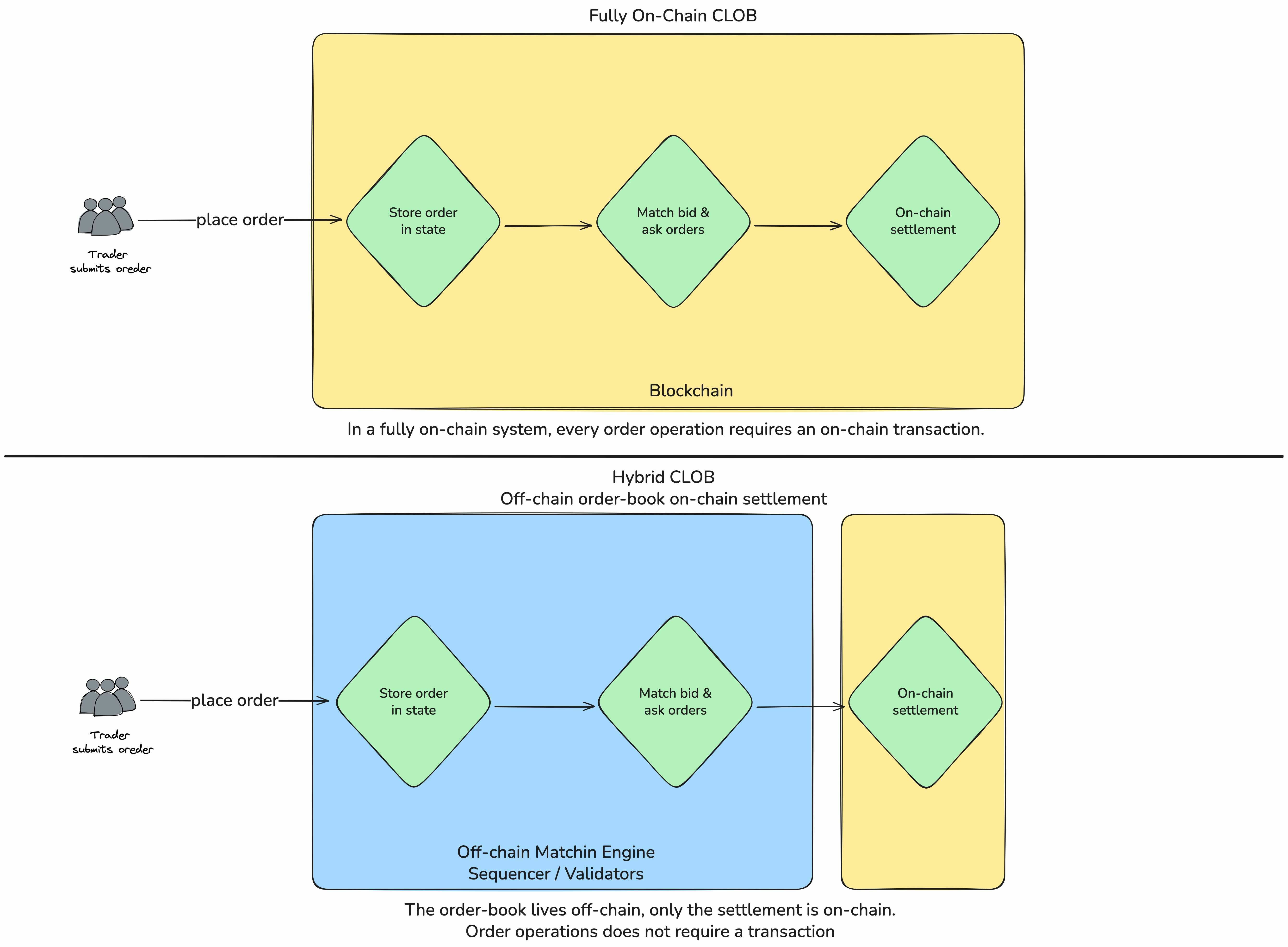

Fully On-Chain Order Books

In the purest design, the entire order book is stored and updated on-chain. Every order is a transaction, and the contract state itself represents the live market. When a buy matches a sell, the blockchain executes the trade and updates balances.

- Pros:

- Perfect transparency — every order and cancel is on-chain and verifiable.

- Full composability — other protocols can plug into the book directly as a public API.

- Cons:

- Extremely heavy: thousands of updates per second are required for a smooth book.

- Only feasible on very high-throughput chains (e.g. Solana’s Serum, Hyperliquid’s L1).

- Costs and latency scale with activity.

Think of it as filing every bid and ask directly in the public ledger. It’s open, but unless the system is built for speed, it grinds to a halt.

Hybrid Order Books

Most modern designs use a hybrid approach. Orders are collected and matched off-chain by sequencers, validators, or specialized servers. Only the outcome — the executed trade — is settled on-chain. This gives users the speed of a centralized exchange, while still relying on the blockchain for custody and finality.

- Pros:

- Millisecond-level matching speed, comparable to Binance or Coinbase.

- Only final trades touch the blockchain, keeping costs low.

- Works on general-purpose L1s and rollups (e.g. dYdX v4 on Cosmos, Aevo on Optimism).

- Cons:

- Trust surface: the off-chain engine must be fair, or cryptographically proven.

- Live order book data may not be globally visible without indexers.

Think of it like a trading pit where bids and asks are shouted, matched instantly, and only the agreed trades are stamped into the official record.

AMM vs. CLOB: Advantages and Disadvantages

AMMs and CLOBs aren’t just two technical designs — they reflect two different philosophies of how markets can work.

AMMswere born as a workaround for Ethereum’s limitations. They thrive on simplicity: liquidity is pooled, prices are set by a curve, and any trader can interact with one transaction. That simplicity comes with trade-offs. Liquidity is always available, but it’s spread thin across wide ranges. Large trades move prices and incur slippage. Liquidity providers earn fees, but also face impermanent loss. Still, the model’s strength is accessibility: anyone with tokens can be a market maker. AMMs democratized trading in a way traditional order books never did.

CLOBs, by contrast, are designed for efficiency. Liquidity is concentrated exactly where traders want it, spreads can be razor-thin, and slippage is near zero if the book is deep. Traders have full control: limit orders, stop losses, post-only orders, leverage — all the tools that professionals expect. But efficiency comes at a cost. Order books only work if there are active market makers constantly updating quotes. Without them, books go empty, spreads widen, and the system collapses. For most of DeFi’s history, that wasn’t sustainable.

The comparison today looks like this:

- Capital efficiency.AMMs require far more capital to achieve the same depth. CLOBs concentrate liquidity more effectively, but only if enough participants are quoting.

- User accessibility.AMMs let anyone LP with a few clicks. CLOBs require active strategies or professional bots.

- Resilience.AMMs always provideaprice, even if liquidity is shallow. CLOBs can deliver better execution — or no execution at all if the book is empty.

- Composability.AMM pools are easy to integrate into other DeFi protocols. CLOBs, especially when run off-chain or on app-chains, are harder to plug into.

Feature-Level Comparison

| Feature | AMM | CLOB |

|---|---|---|

| Market orders | ✅ Always available (swap against pool) | ✅ Executes instantly against best bids/asks |

| Limit orders | ❌ Not natively supported; needs bots or extra protocols | ✅ Native; core mechanic of the book |

| Stop-loss / Take-profit | ❌ Not possible without automation or vaults | ✅ Standard, directly supported |

| Post-only / IOC | ❌ No concept of advanced order instructions | ✅ Standard execution controls |

| Leverage / derivatives | ⚠️ Possible via specialized AMM designs (e.g. Synthetix, GMX) | ✅ Natural fit; most perp/derivatives DEXs are CLOB-based |

| Execution precision | ❌ Slippage unavoidable on large trades | ✅ No slippage if book depth exists |

The Return of Order Books

For years, order books were the model that DeFi couldn’t have. They were too heavy, too expensive, and too slow for Ethereum and most early blockchains. AMMs weren’t a choice so much as a necessity. But starting around 2023, the infrastructure story began to change, and with it, the design space for DEXs.

High-performance chains: Blockchains like Solana, Sei, and Hyperliquid’s bespoke L1 showed that sub-second block times and thousands of transactions per second were achievable in practice. These systems could finally handle the volume of updates an order book demands.

Layer-2 rollups: Optimistic and zk-rollups on Ethereum unlocked faster and cheaper execution environments, while still settling back to Ethereum for security. An order book that would have been unusable on L1 could suddenly run on L2 with millisecond-level updates and low fees.

Data availability layers: New modular designs (e.g. Celestia, EigenDA) reduced the cost of posting large volumes of off-chain data on-chain. For order books, this meant orders and cancels could be gossiped off-chain, with only the essential data published cheaply to a DA layer for auditability.

Cryptographic proofs: Zero-knowledge proofs made it possible to verify off-chain order matching was done fairly, without replaying every transaction on-chain. This lowered the trust assumptions for hybrid designs where sequencers or validators run the matching engine.

Together, these advances made order books viable again, not just in theory, but in production. And the market responded quickly. By 2024–2025, platforms like Hyperliquid, dYdX v4, Aevo, and Vertexwere attracting serious volumes with CLOB-native designs, offering a decentralized alternative that felt closer than ever to Binance or Coinbase.

The return of order books doesn’t mean AMMs will vanish. Instead, it signals that DeFi is maturing: AMMs and CLOBs are becoming complementary tools. AMMs are still unmatched for bootstrapping long-tail assets and offering simple swaps, while CLOBs dominate in high-volume markets where precision, depth, and advanced trading tools matter most.

Case Studies of Modern CLOB DEXs

The return of order books in DeFi isn’t a single design. Different teams have made different trade-offs in how much happens on-chain versus off-chain, and how they balance speed, transparency, and decentralization. Four leading projects illustrate the spectrum.

Hyperliquid – The Fully On-Chain Vision

Hyperliquid runs on its own custom Layer-1 blockchain, designed specifically for order-book trading. It uses a HotStuff-derived consensus (“HyperBFT”) to achieve ~70ms block times, meaning every order and cancel is part of the canonical chain state. Traders interact through APIs almost indistinguishable from Binance, but under the hood every update is a transaction written into blocks.

- What’s unique: Entire order book lives on-chain, not in memory. Matching happens deterministically at the consensus layer.

- Technical strength: High throughput (tens of thousands of orders/sec) and advanced order types supported natively by the protocol.

- Trade-offs: Small validator set (dozens, not thousands), making censorship resistance weaker than Ethereum-class chains. Limited DeFi composability since the chain is purpose-built.

dYdX v4 – The App-Chain Model

dYdX’s v3 on StarkEx hit scaling ceilings: ~10 trades/sec, limited market creation, and a single off-chain matching server. To fix this, v4 migrated to a Cosmos app-chainwhere every validator maintains an in-memory copy of the order book. Orders are gossiped peer-to-peer, and the block proposer for each round deterministically matches them, with final state committed on-chain.

- What’s unique: Order matching is decentralized across 50–60 validators, eliminating reliance on a single off-chain sequencer.

- Technical strength: Achieves ~2,000 TPS and 1s finality, while supporting cross-margin across 175+ perpetual markets.

- Trade-offs: Sacrifices direct Ethereum composability; liquidity sits in its own Cosmos ecosystem. Validators must run high-performance infra to handle the order flow, raising centralization risks over time.

Aevo – The Rollup + DA Approach

Aevo runs on a custom Optimism OP Stack rollup, but uses Celestia for data availability. Orders are held in a centralized matching engine for speed, with matched trades posted to Ethereum via rollup contracts, and raw order data stored cheaply in Celestia blobs for auditability. Collateral is wrapped into aeUSD, which earns yield while acting as trading margin.

- What’s unique: Modular design - execution on rollup, settlement on Ethereum, data on Celestia.

- Technical strength: ~5,000 TPS capacity, with cheap order data posting and capital efficiency through aeUSD.

- Trade-offs: Matching engine is currently centralized; trust minimized but not eliminated. Liquidity siloed unless external aggregators bridge it.

Vertex – The Hybrid AMM + Order Book

Vertex, built on Arbitrum, combines a constant-product AMM (fully on-chain) with an off-chain order book managed by a sequencer. The AMM provides baseline liquidity, represented as virtual limit orders in the book. If the sequencer fails, the system falls back into “AMM-only mode” where trades are still possible. It also integrates a unified risk engine for spot, perps, and lending.

- What’s unique: Hybrid design ensures resiliency - trading never halts, even if the off-chain engine does.

- Technical strength: Cross-margining, on-chain clearinghouse for collateral, and multi-chain expansion plans (“Vertex Edge”) to aggregate liquidity across ecosystems.

- Trade-offs:The matching engine is still centralized today, meaning order flow depends on a single sequencer. And because the order book integrates AMM liquidity as “virtual limit orders,” the sequencer must constantly refresh these to reflect the pool’s changing on-chain state.

| Model | Project Example | How the Order Book Lives | Strengths | Trade-offs |

|---|---|---|---|---|

| Fully On-Chain | Hyperliquid | Entire OB stored on-chain; consensus layer handles matching | Max transparency; CEX-level speed on custom L1 | Small validator set; low composability |

| Validator-Governed Off-Chain | dYdX v4 | Orders gossiped among validators; proposer matches deterministically | Decentralized matching; ~2,000 TPS; cross-margining | High infra demands; no Ethereum composability |

| Rollup + DA Off-Chain | Aevo | Orders matched centrally; trades settle on Ethereum; data in Celestia | Modular scaling; capital efficiency (aeUSD collateral) | Centralized matcher; liquidity siloed |

| Hybrid AMM + Order Book | Vertex | Off-chain OB + on-chain AMM fallback; unified on-chain risk engine | Resiliency (fallback to AMM); cross-margin accounts | Centralized sequencer; complexity of hybrid design |

Design Decisions and Trade-offs

Looking across Hyperliquid, dYdX v4, Aevo, and Vertex, it’s clear there isn’t one “best” CLOB design. Each has chosen an architectural path shaped by what it wants to optimize for. The common thread is that every choice carries a trade-off.

Performance vs. Decentralization.

- Hyperliquid achieves CEX-like speed by running everything on a purpose-built chain with a small validator set. That concentration enables sub-second finality, but also reduces censorship resistance compared to Ethereum-class systems.

- dYdX v4 pushes matching into validator memory, improving decentralization, but requires validators to run heavyweight infrastructure, potentially narrowing who can participate.

Fairness vs. Latency.

- Order books introduce MEV-style risks: whoever sees an order first can try to act on it. Sei experimented with frequent batch auctions to level the playing field, but at the cost of extra delay. dYdX v4 stuck with continuous matching to maximize speed, accepting that latency arbitrage may remain.

- It’s a recurring dilemma: should DeFi order books feel exactly like Wall Street (blazing fast but exploitable by the quickest bots), or should they build in mechanisms to slow things down for fairness?

Composability vs. Decentralization.

- dYdX left Ethereum to control its own app-chain, which gave it sovereignty over fees, listings, and upgrades. But it lost Ethereum’s native composability. Other DeFi protocols can’t just plug into dYdX liquidity the way they can with Uniswap pools.

- Vertex took the opposite path: it lives on Arbitrum, and its AMM component is directly composable with other on-chain protocols. But its matching engine remains centralized today, so the system is less decentralized than app-chain models like dYdX v4.

Transparency vs. Efficiency.

- Hyperliquid’s fully on-chain design makes every order visible in the chain state, but at the cost of requiring a purpose-built chain to handle the throughput.

- Aevo sacrifices transparency in the short term - traders don’t see every order, only fills - but balances that with efficiency and cheap scaling via Celestia DA.

These are not just engineering questions. They shape who uses the platform, how much trust is required, and how each exchange positions itself in the broader DeFi ecosystem. A derivatives-focused DEX like Aevo is happy to optimize for efficiency even if it means centralizing matching. A general-purpose chain like Hyperliquid wants to prove a philosophical point: that a DEX can be as fast as Binance without giving up custody.

In the end, these designs force a choice: speed, fairness, decentralization, composability - you can’t maximize all at once. Every CLOB DEX lives somewhere along that spectrum.

Risks and Open Questions

The return of order books in DeFi is real, but it’s not without risks. Each design choice that enables CLOB performance also opens new uncertainties.

Liquidity fragmentation. In the AMM era, most trading consolidated around a handful of Ethereum pools. With CLOBs, liquidity is spreading across new chains and app-specific environments. Hyperliquid has its own L1, dYdX is on Cosmos, Aevo runs a custom rollup, and Vertex anchors to Arbitrum. For traders, this means markets are deeper on individual venues but siloed from one another. The open question is whether bridges, aggregators, or multi-chain order routing can stitch these silos into something resembling a unified market, or whether fragmentation will persist.

Centralization of matching engines. Most of today’s designs rely on sequencers or validator sets to run off-chain matching logic. dYdX decentralizes this across validators, but Aevo and Vertex still depend on single operators. Hyperliquid’s validator set is small compared to Ethereum. In each case, censorship-resistance and transparency depend not just on code but on trust in those running the engines. Will these teams successfully decentralize matching without breaking performance?

MEV and fairness. Order books reintroduce the latency games of traditional markets. Whoever can see and act on an order first has an edge. Some projects, like Sei, experiment with frequent batch auctions to neutralize this, but others (Hyperliquid, dYdX) prioritize raw speed. The unresolved question is whether DeFi traders will accept Wall Street–style latency arbitrage, or demand fairness mechanisms even at the cost of a few extra milliseconds.

Security and liveness. Fully on-chain systems like Hyperliquid take on the burden of scaling a new L1. Hybrid systems rely on sequencers that could go down. Vertex mitigates this with an AMM fallback, but not every project has such a safety net. What happens to user confidence if a sequencer outage halts trading in the middle of a volatile market?

Governance and decentralization roadmaps. Most of these projects launched with centralized control over validators, sequencers, or listing processes. Each promises to decentralize over time — but history shows this isn’t guaranteed. The risk is that DeFi repeats the centralization trajectory of CeFi, only with a blockchain veneer. Whether governance truly opens up will determine if these platforms are sustainable, or just interim bridges to something else.

Final Thoughts / TL;DR

Decentralized exchanges have come full circle. The first generation tried order books, but Ethereum couldn’t support them. AMMs emerged as the pragmatic solution, enabling DeFi Summer and billions in trading volume. Now, with faster chains, modular rollups, and new data layers, order books are back, this time with the infrastructure to make them viable.

Hyperliquid, dYdX v4, Aevo, and Vertex each showcase different answers to the same challenge: how to deliver CEX-level speed without giving up DeFi’s promise of self-custody and transparency. None of them has solved every problem. Some trade decentralization for performance. Others sacrifice composability for sovereignty. But together, they’ve proven that CLOBs can exist on-chain and compete.

The future is unlikely to be a winner-take-all. AMMs still shine for long-tail assets and bootstrapping new markets. CLOBs dominate where precision, depth, and advanced features matter most. Hybrids like Vertex suggest that the two models may even converge.

The core insight: CLOBs are no longer an impossibility in DeFi, they’re a design choice. And like all choices in this space, it’s about trade-offs: speed vs. decentralization, fairness vs. latency, sovereignty vs. composability. Builders and traders will need to decide which trade-offs matter most.